ID Theory is a London-based cryptoasset investment firm. Our weekly Insights report provides the latest key macro as well as on-chain data for Bitcoin. If you would like to receive insights directly to your inbox, you can subscribe here.

Correlations

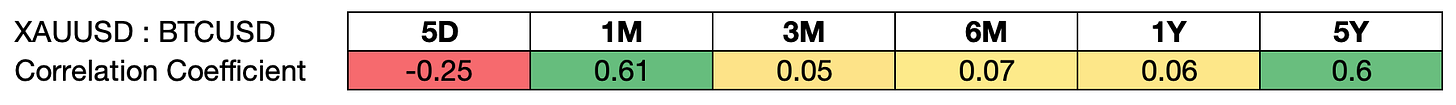

BTC and Gold

Gold has served as a safe haven asset for 1000’s of years.

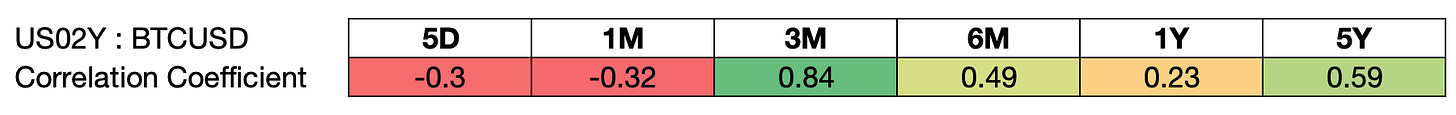

BTC and Inverted US 2 Year Treasury Yield

In a risk-off environment Treasury yields drop (and hence inverted yields rise).

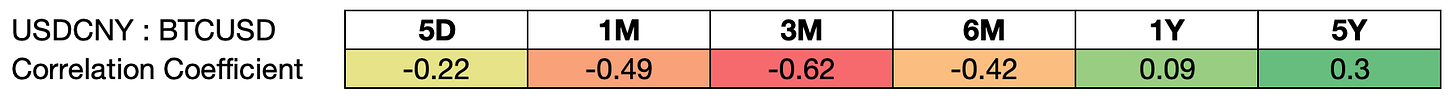

BTC and USD/CNY

Weakening CNY may lead to a greater demand for capital flight from China.

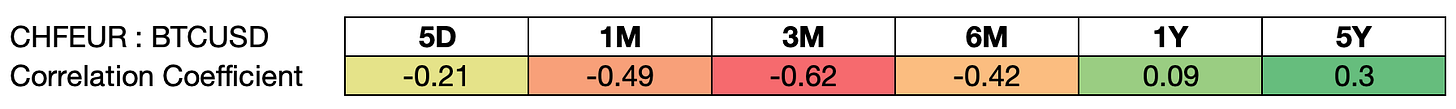

BTC and CHF/EUR

The Swiss Franc (CHF) is a safe haven currency.

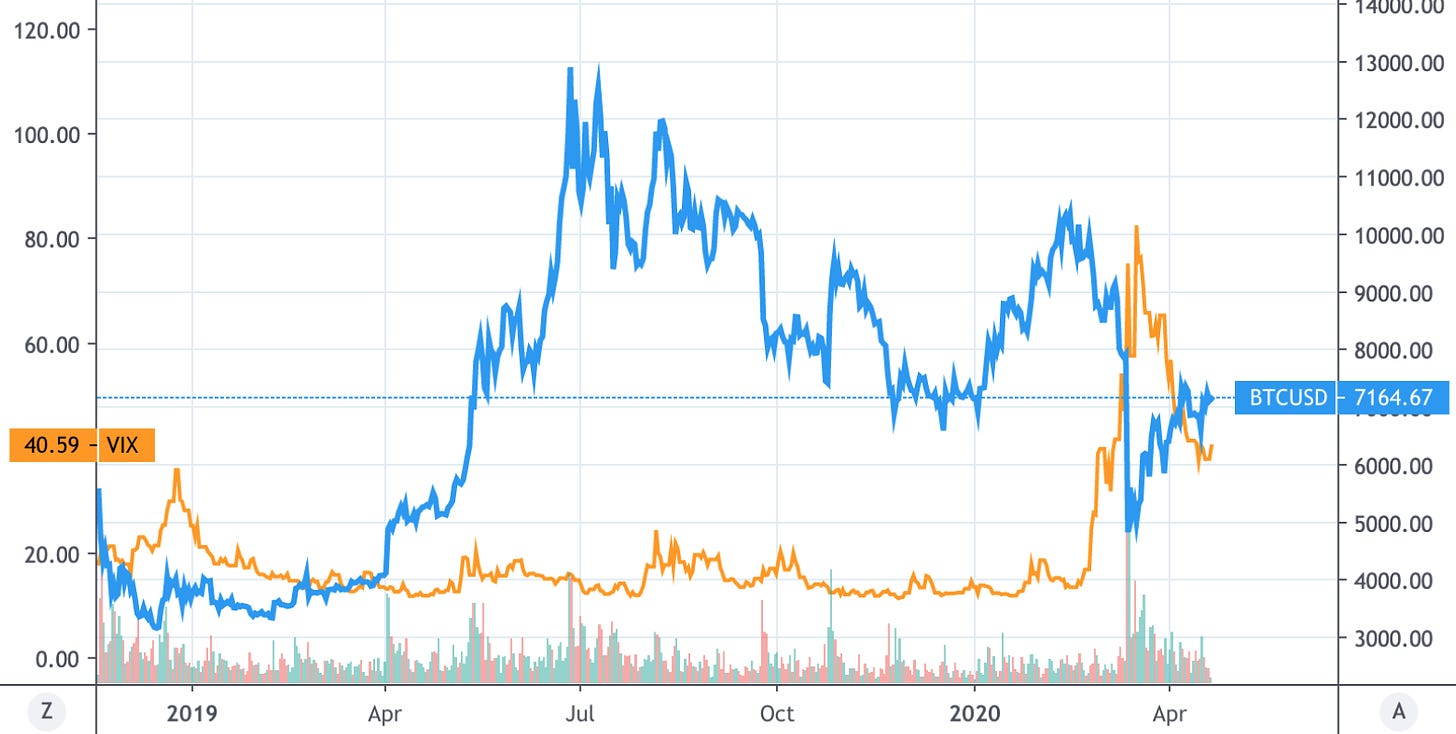

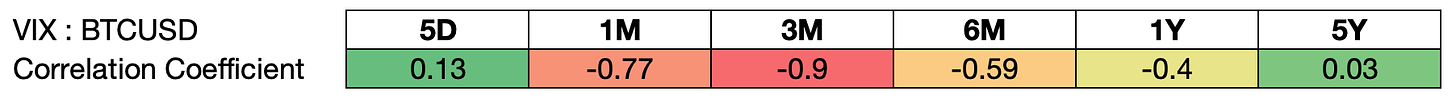

BTC and VIX

Volatility (represented by the VIX) generally increases in times of economic uncertainty.

BTC and S&P 500

The S&P 500 generally rises as risk appetite increases.

BTC Weekly SMAs and MACD

BTC continues its re-bound from dipping slightly below the 200w MA (historically an area of key long-term support) in early March. The weekly MACD continues to show increased bullish momentum.

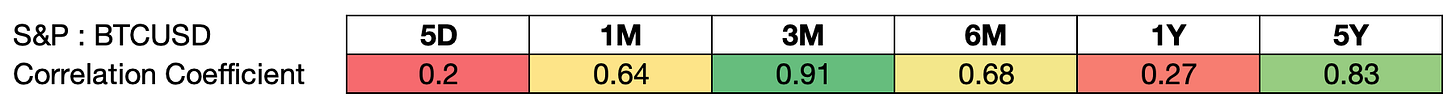

Bitcoin Price Action

2020 is now currently the fourth worst performing year since 2013.

Bitcoin Derivative Market

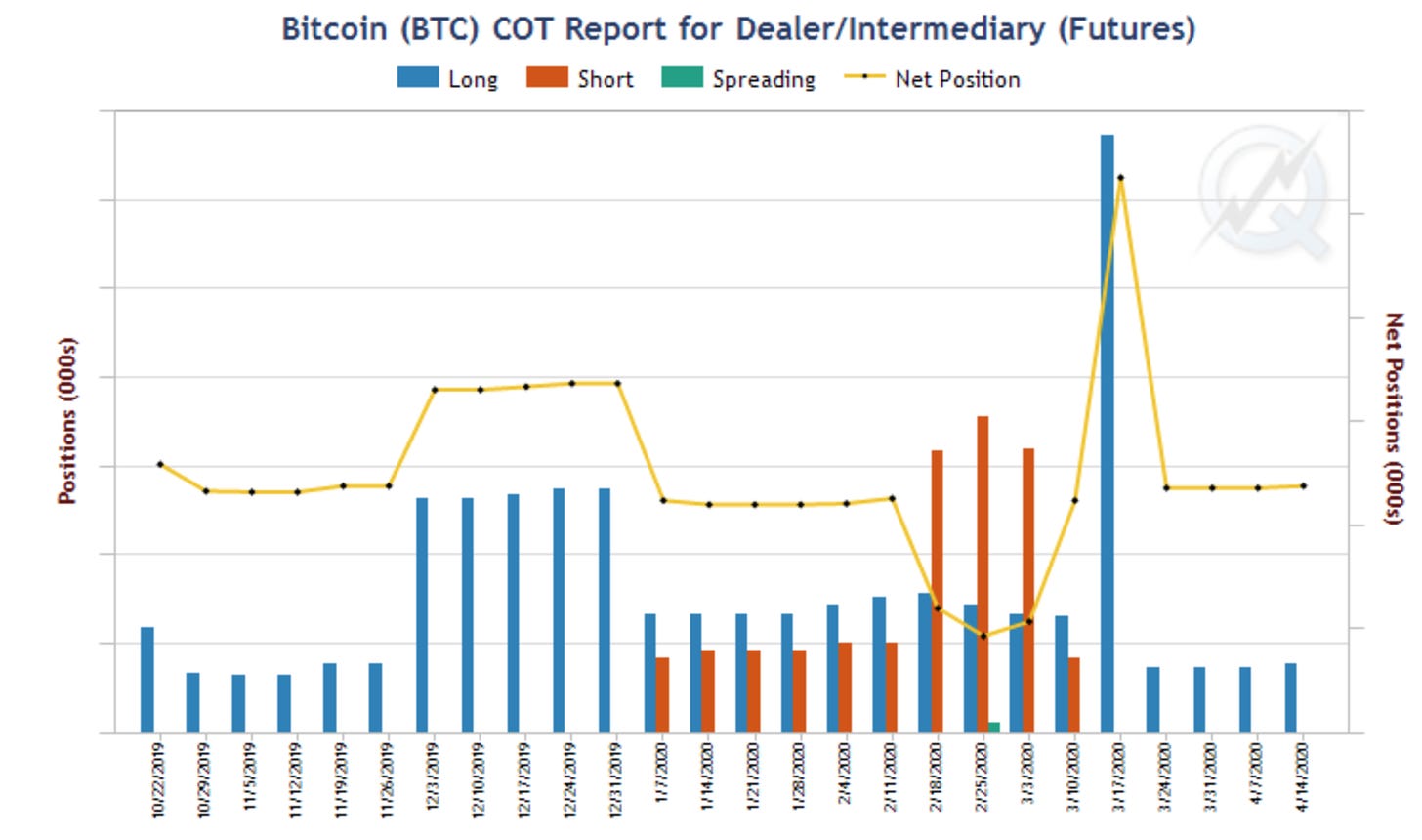

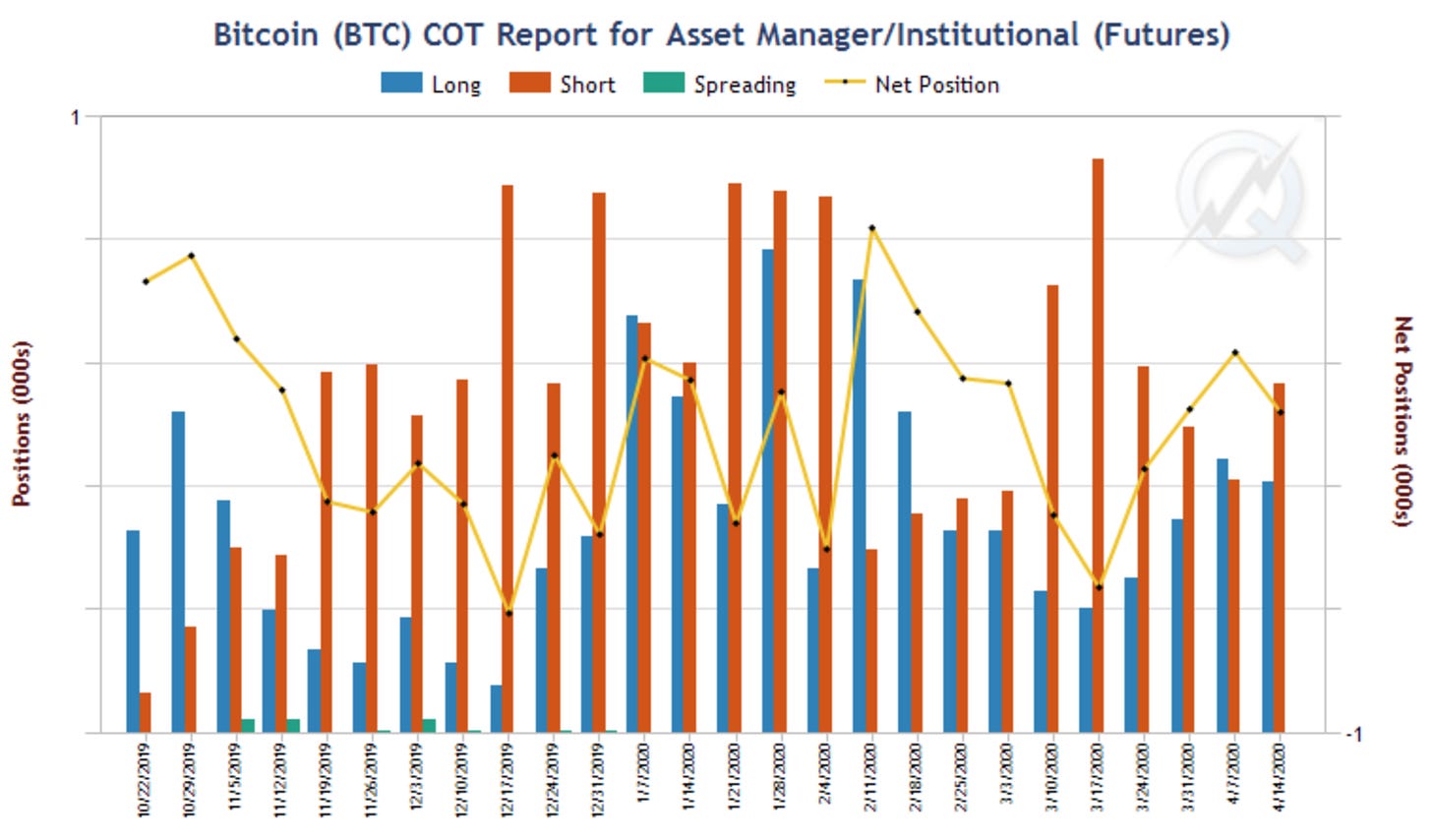

The Commitment of Traders (COT) is a weekly report issued by the CFTC enumerating the holdings of participants in the Futures market. Dealer/Intermediary represents the sell side, Asset Manager/Institutional represents the buy-side.

There has been no shift in sentiment for dealers/intermediaries from last week. Asset managers have now shifted to a predominantly short stance.

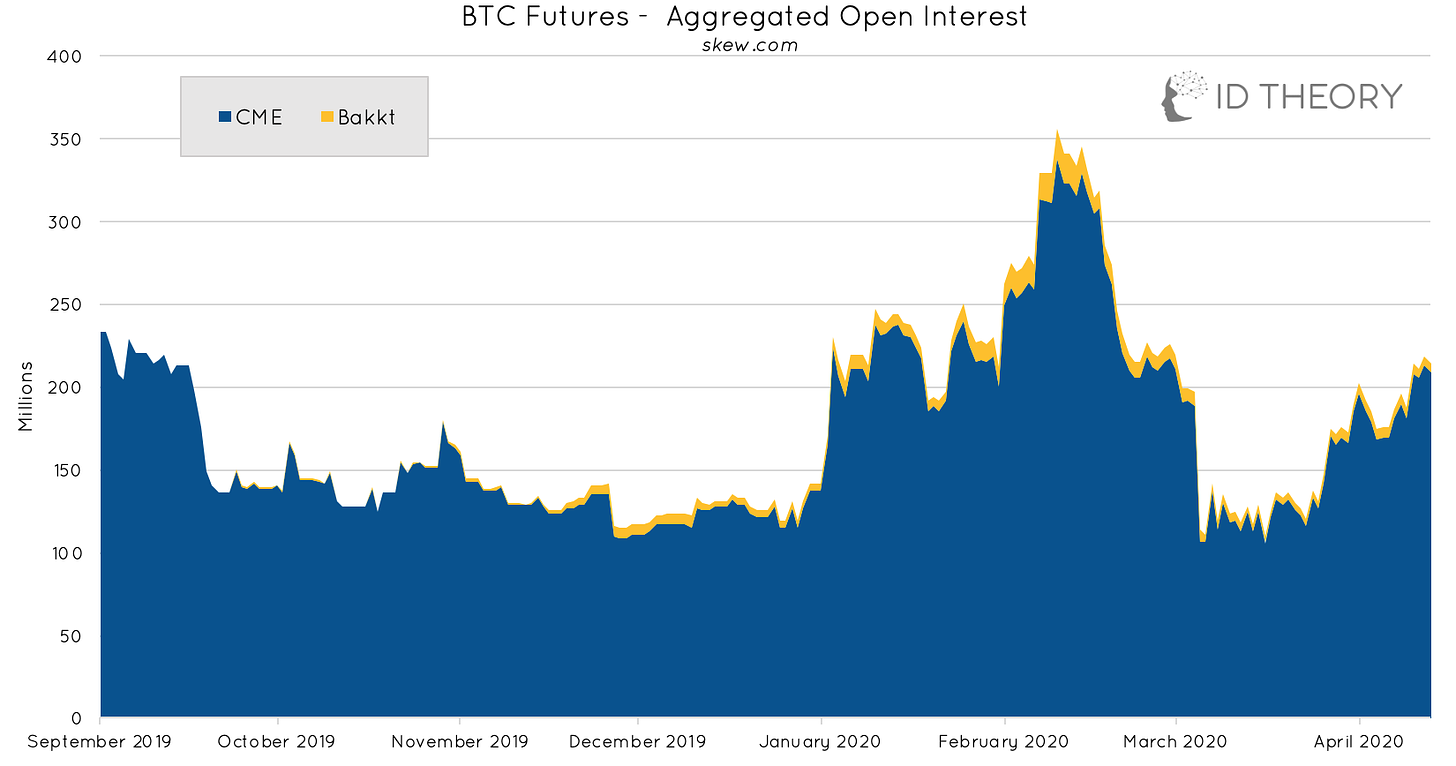

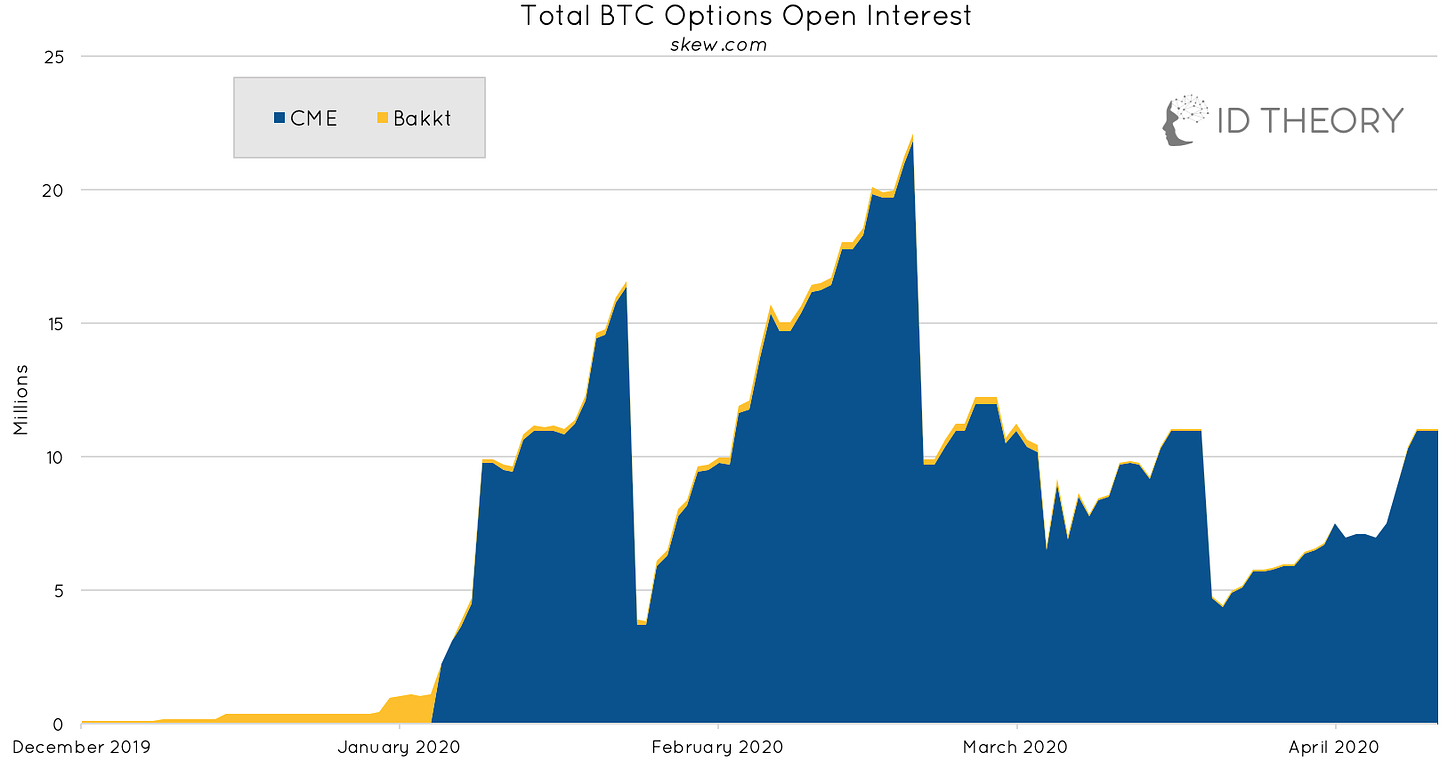

Open interest shows the USD value of open contracts offered by various platforms.

Open interest has recovered significantly from the March lows, indicating a resurgence in institutions that want to buy bitcoin.

Fundamentals

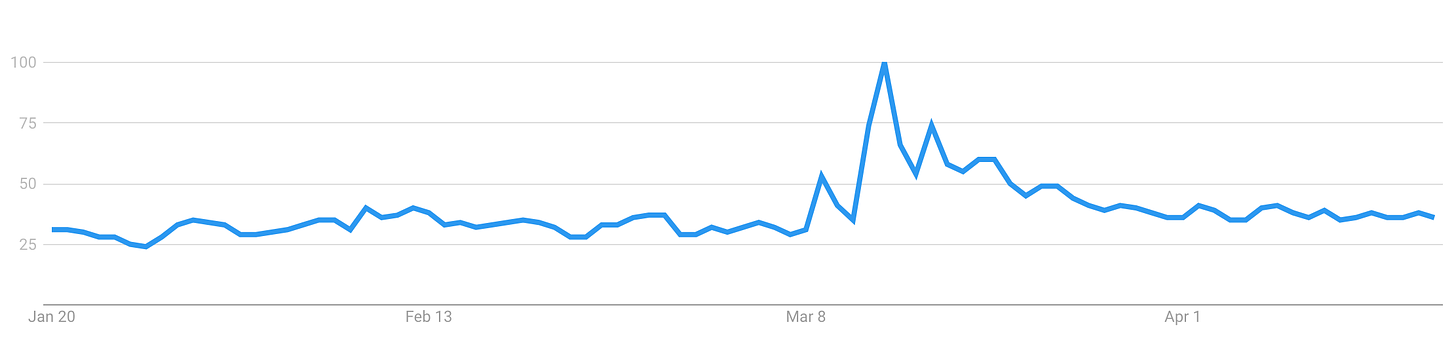

Google Trends - ‘Bitcoin’

Past 3 months - Worldwide

Google searches for ‘bitcoin’ has remained largely flat since the start of April.

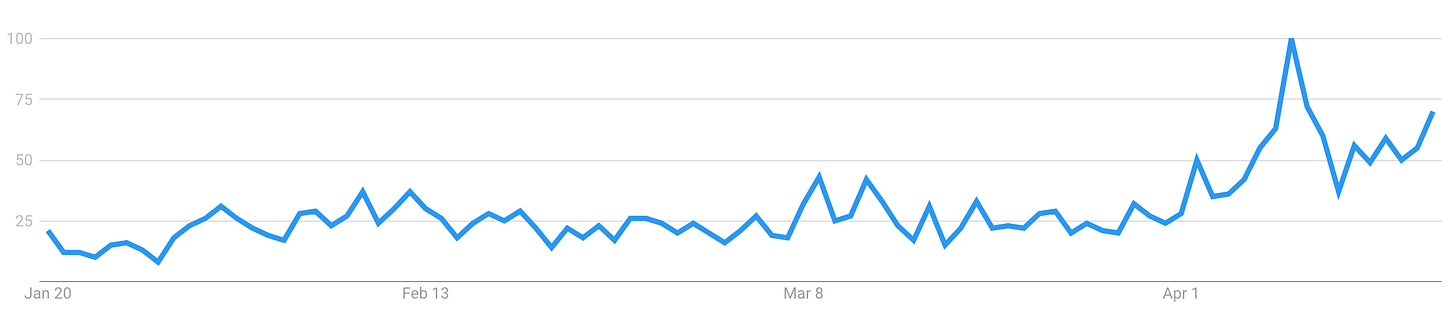

Google Trends - ‘Bitcoin halving’

Past 3 months - Worldwide

Google searches for ‘Bitcoin halving’ has picked up momentum in the last week as we approach the halving event in May.

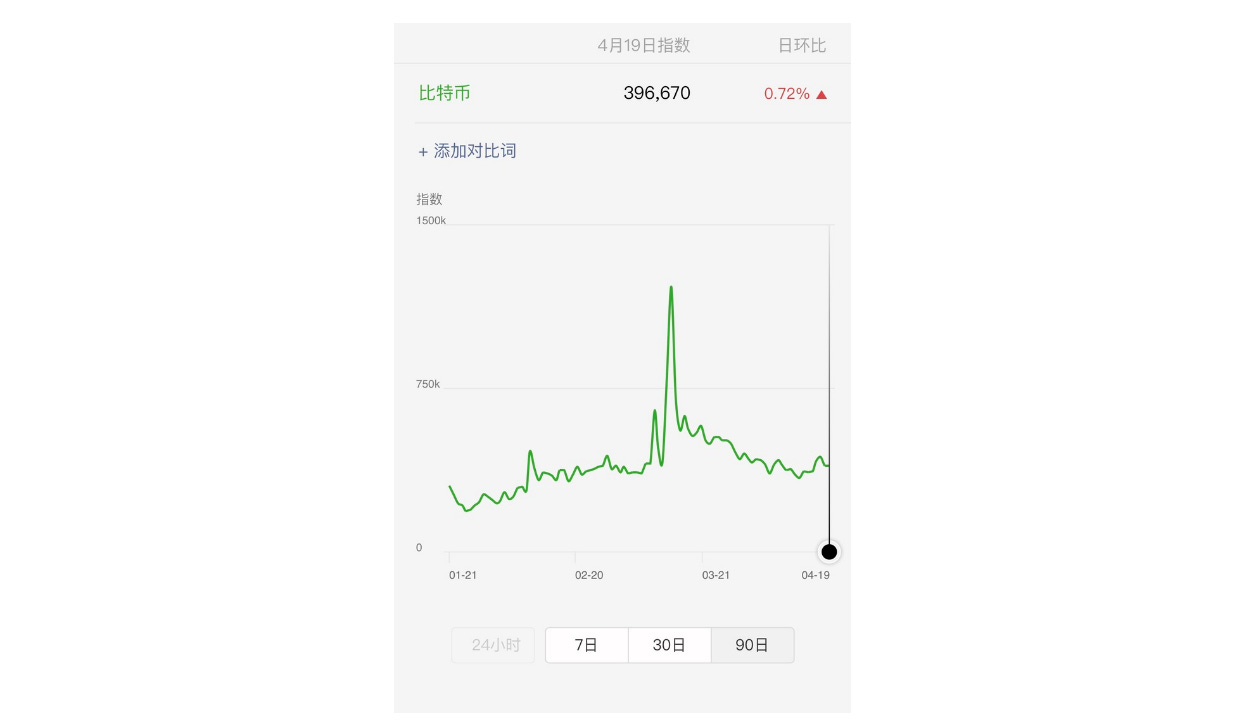

WeChat Index - ‘Bitcoin’

Searches for ‘Bitcoin’ has climbed 18% since the local low seen on the 12th April indicating growing interest.

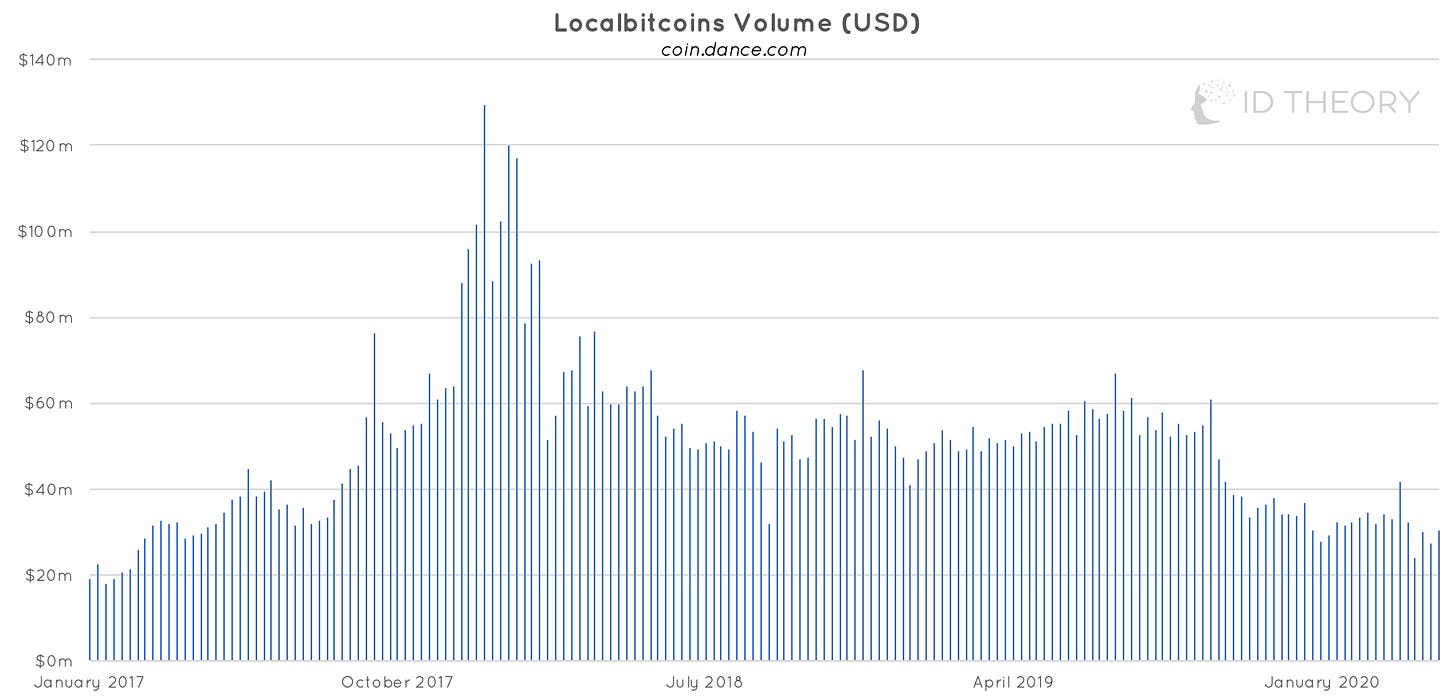

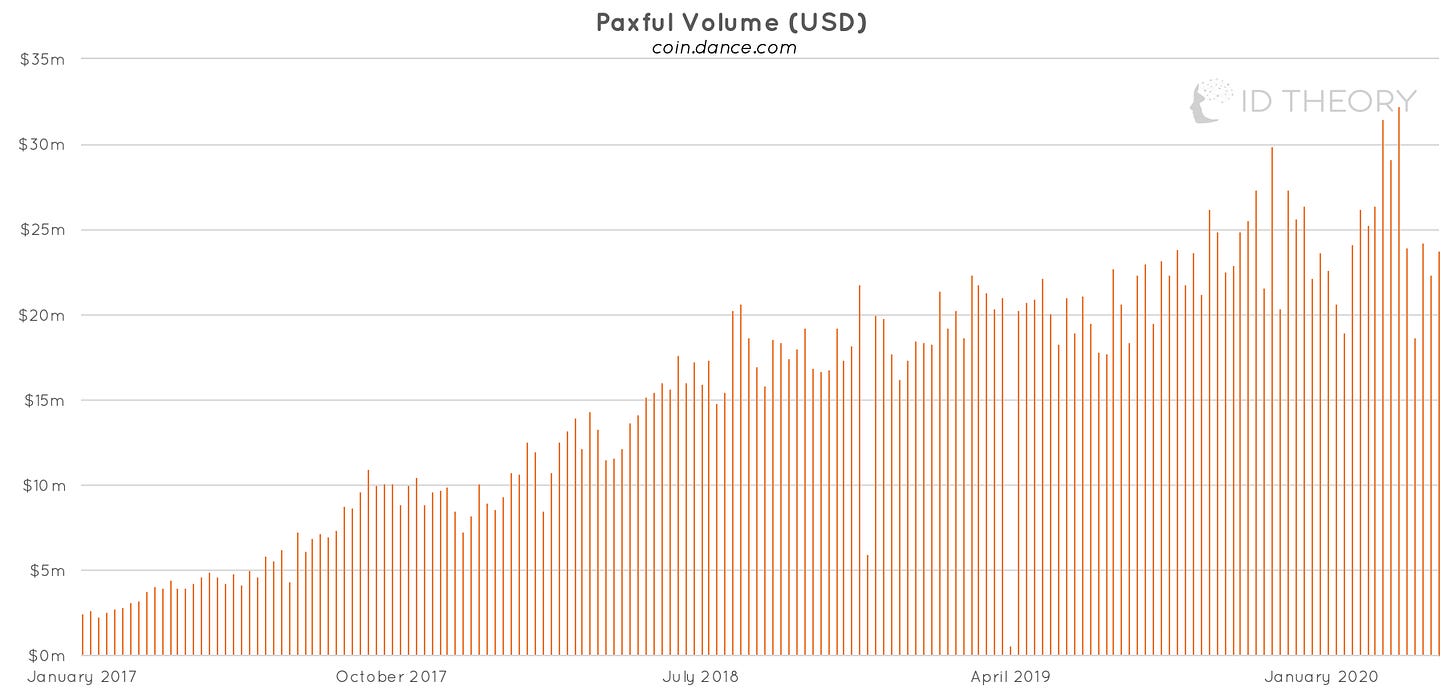

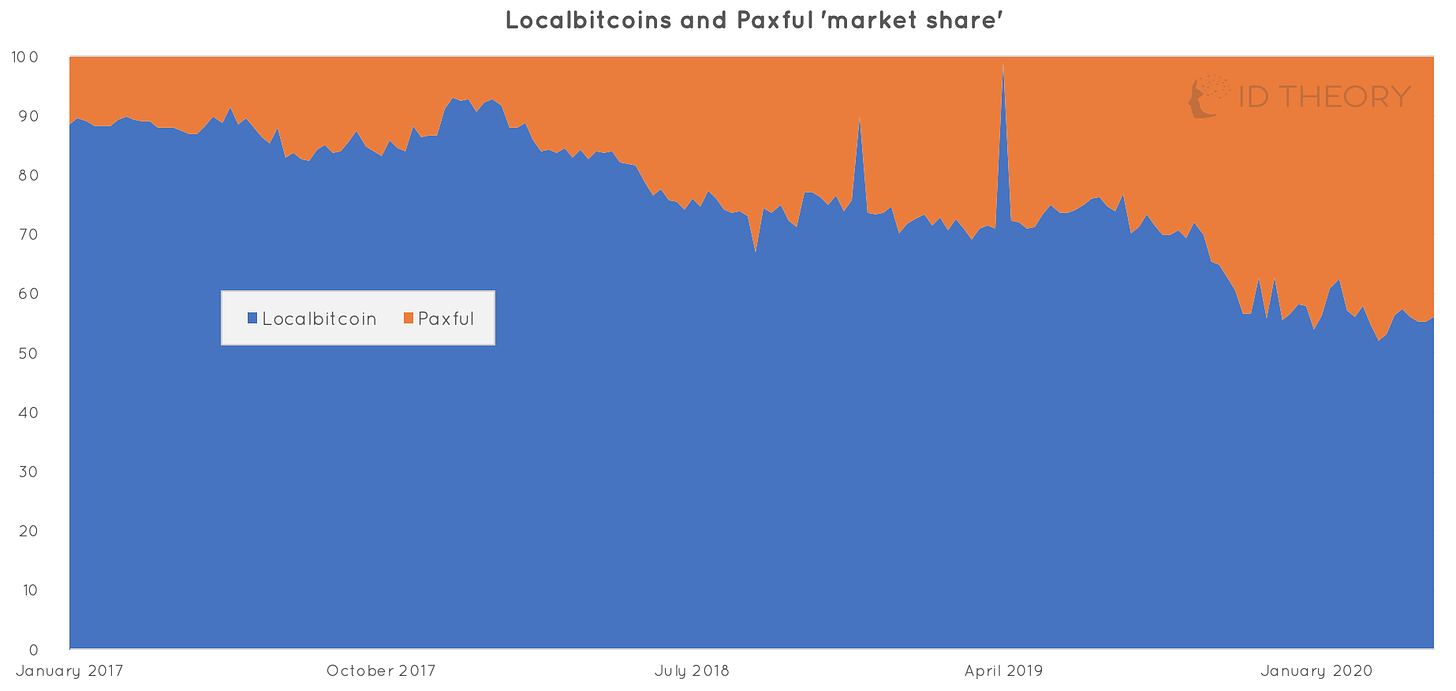

Localbitcoins and Paxful Volume - Global

USD volume on Localbitcoins is up 11% from the previous week.

USD volume on Paxful is up 6% from the previous week.

Localbitcoins has gained market share against Paxful as volume Localbitcoins now represents ~60% of the combined USD volume.

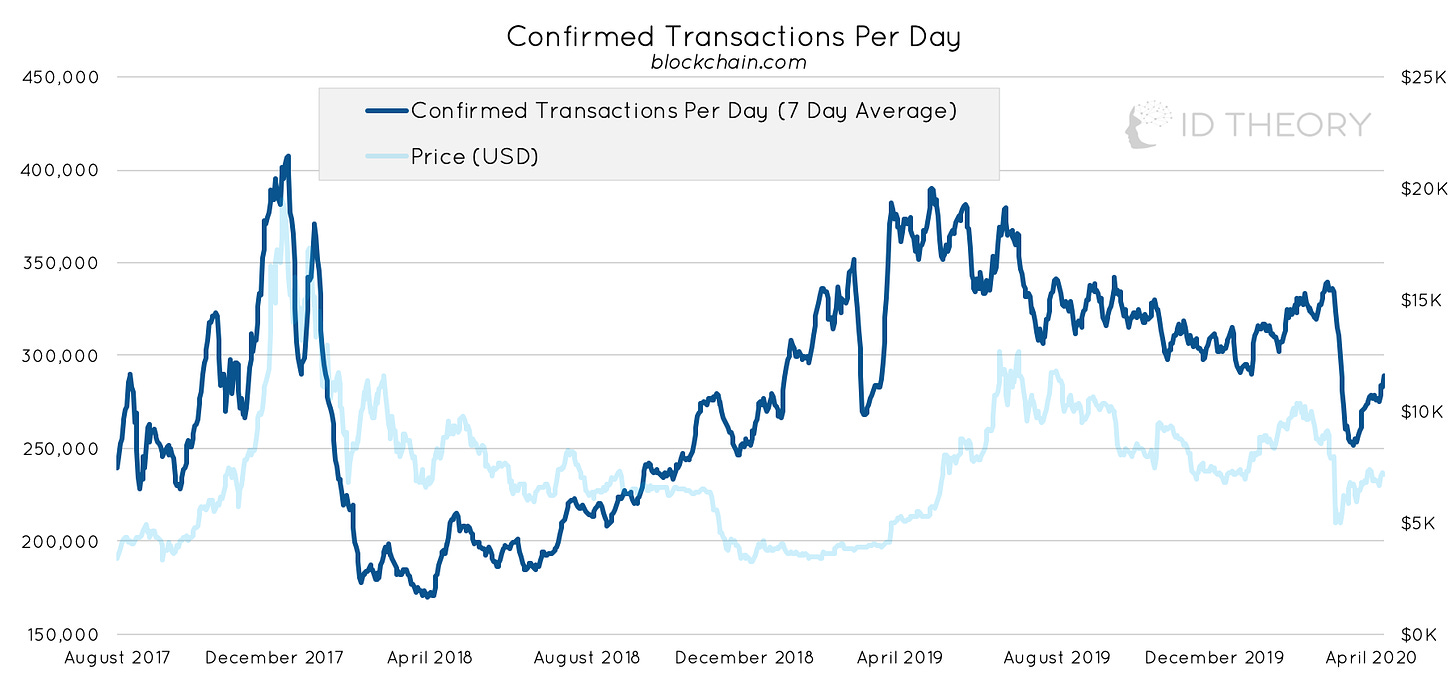

Confirmed Transactions Per Day

Confirmed transactions are up 4% since last week but down 2% YTD.

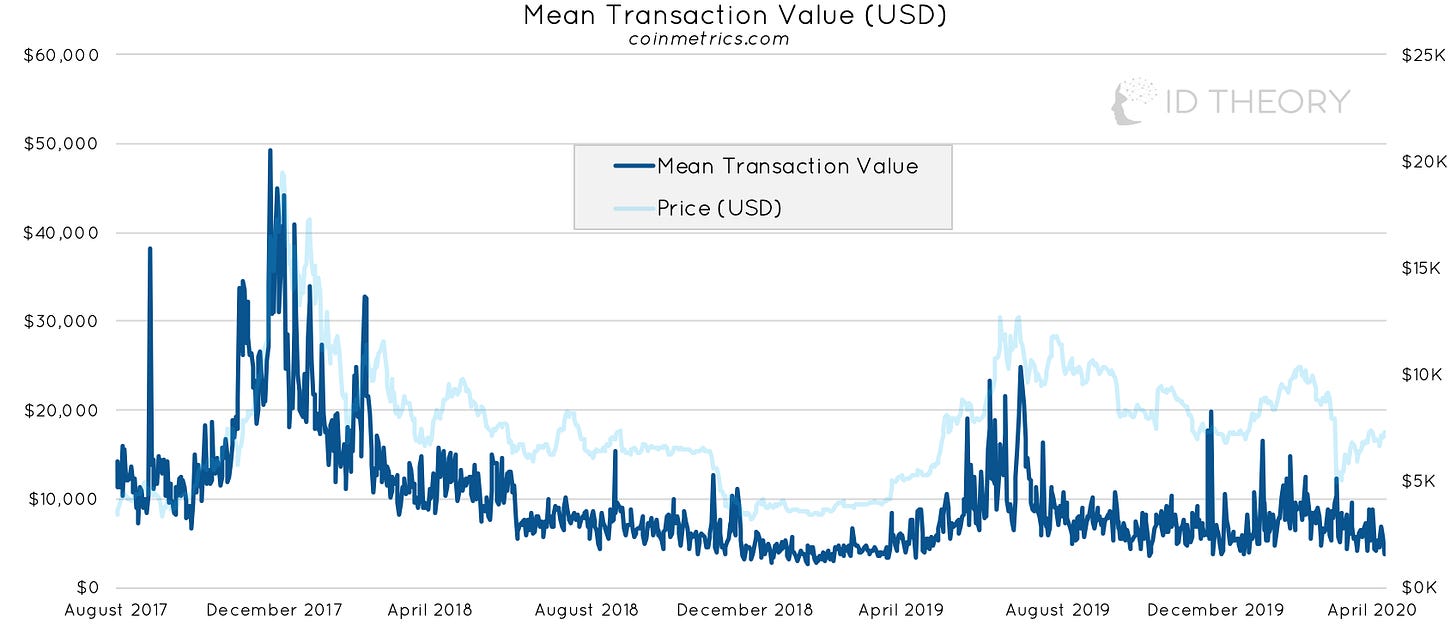

Mean Transaction Value

The mean transaction value has decreased 7% for the week but is up 6% YTD.

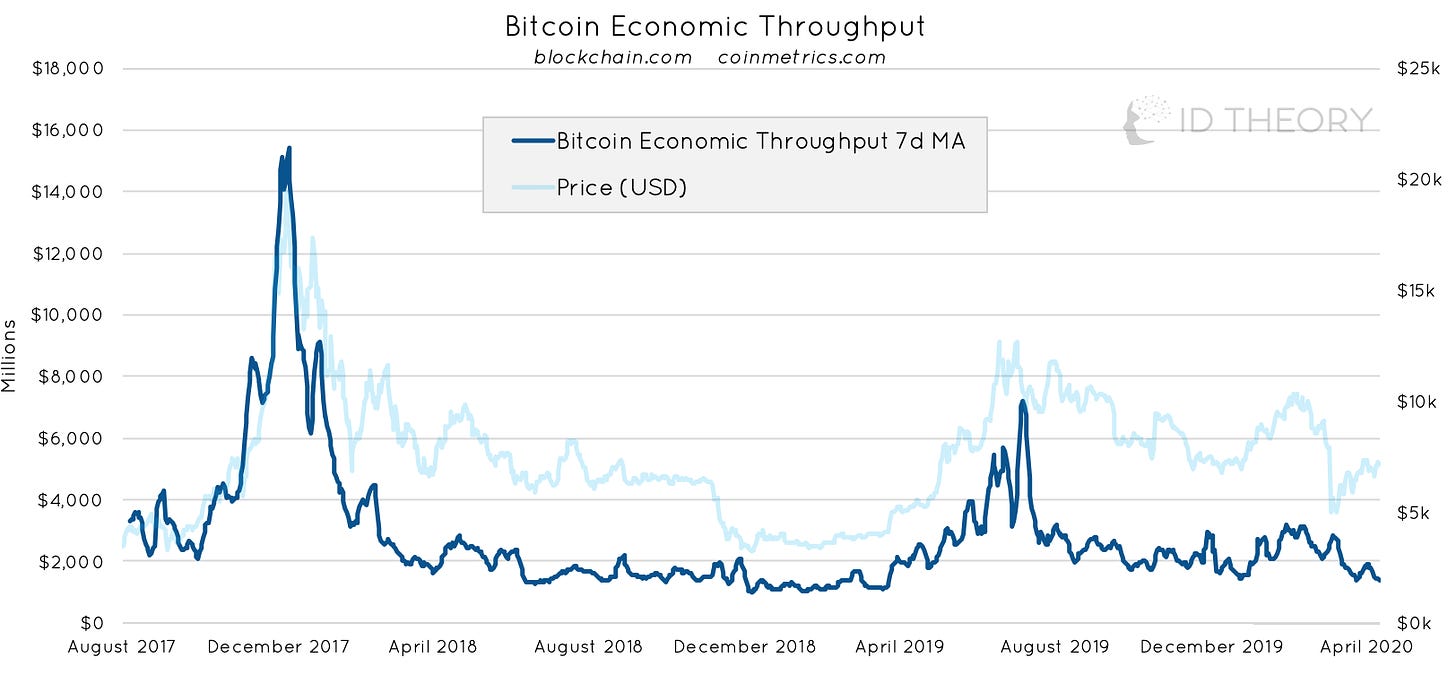

Bitcoin Economic Throughput

Current economic throughput is down 21% since last week hovering around $1.41Bn USD and is down 3% YTD on the 7d MA (moving average).

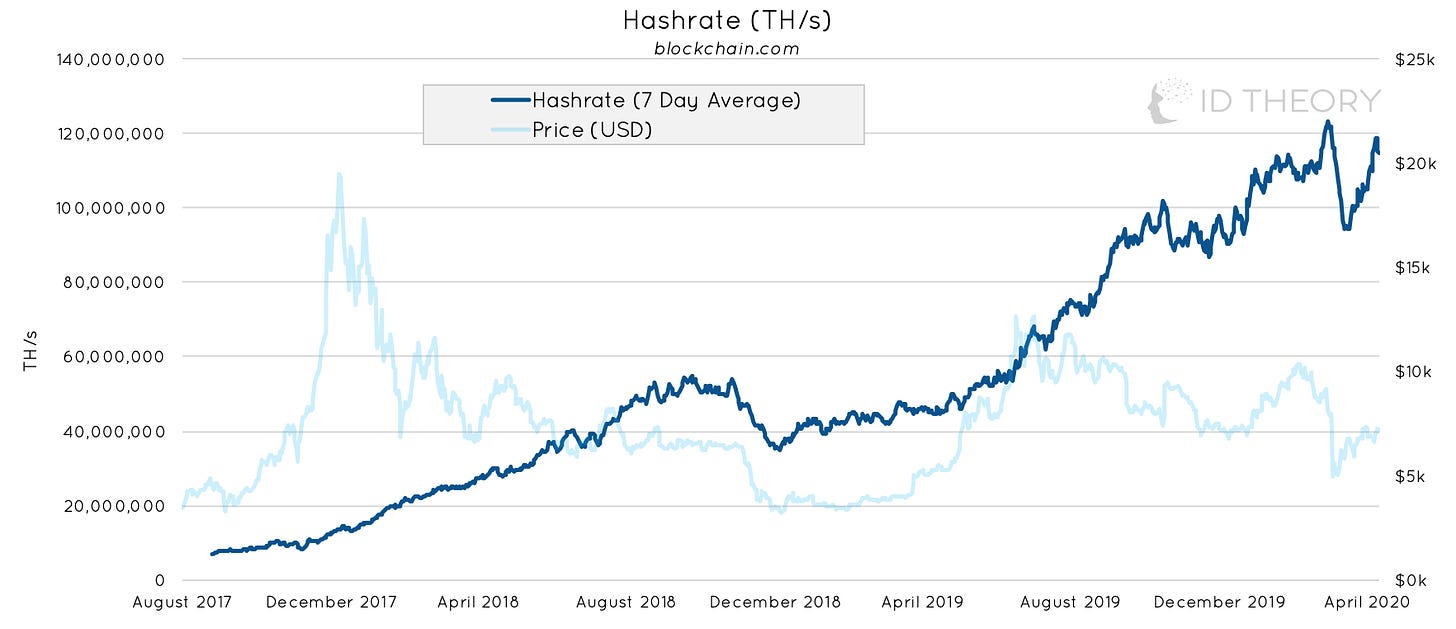

Hashrate

Bitcoin hashrate (7 day moving average) is up 4% for the week. Hashrate is up 18% YTD. It is currently at 115m TH/s on the 7 day moving average.

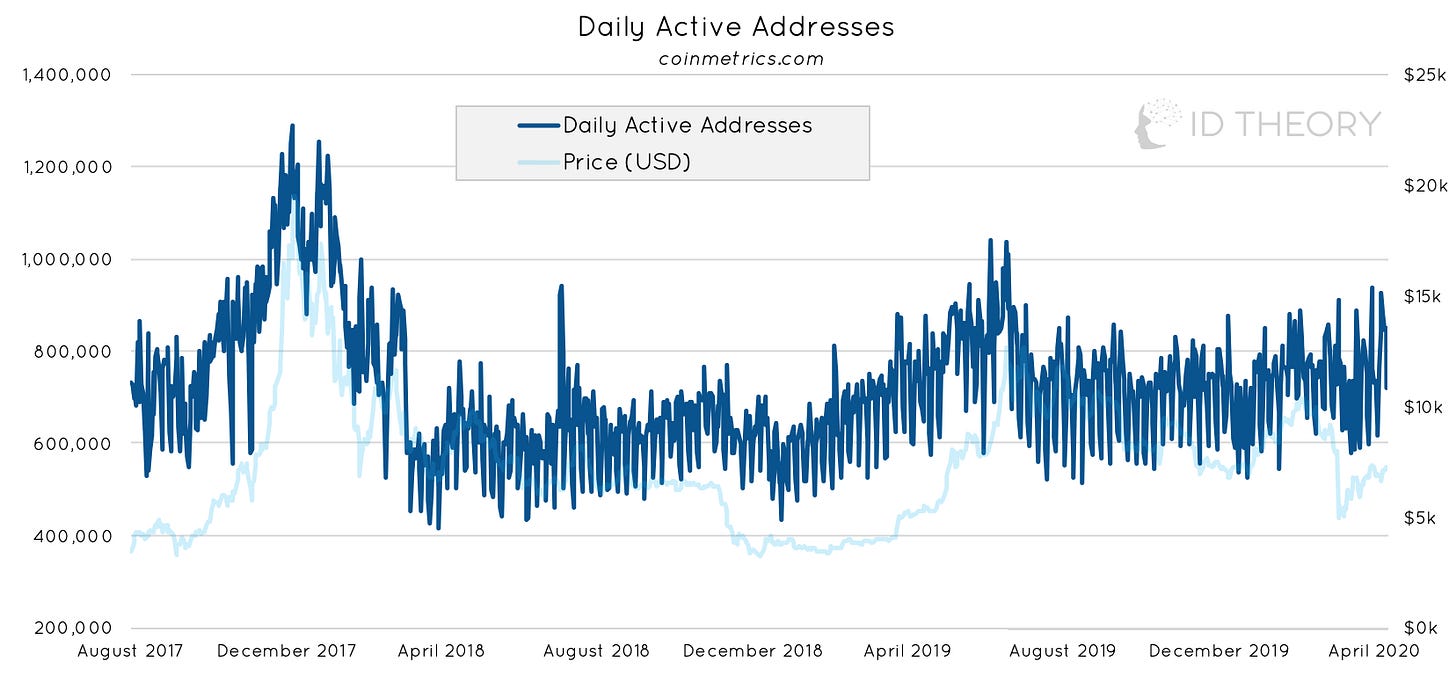

Daily Active Addresses

The daily active addresses count for Bitcoin is up 16% from the last week. Daily active address count is up 37% YTD.

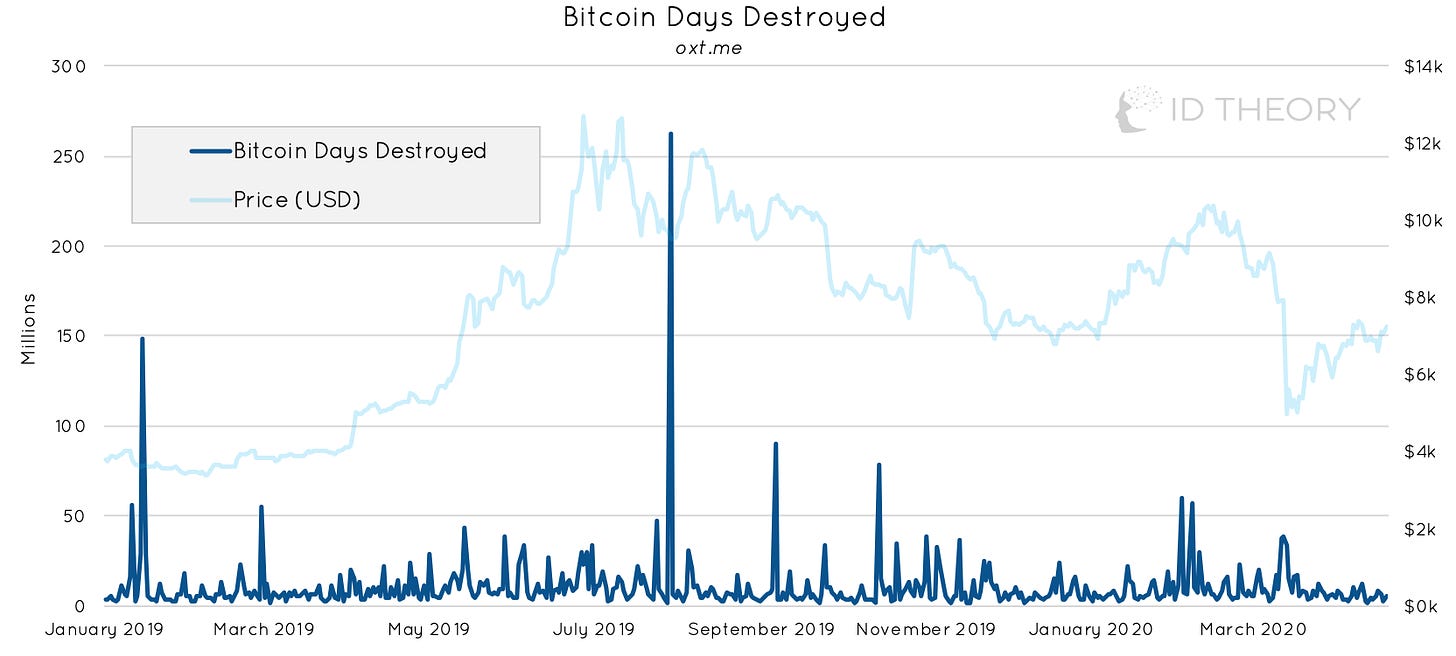

Bitcoin Days Destroyed

During the last week there has not been any significant BDD activity observed.

Realised Cap

Realised Cap (Coinmetrics, 2018) is currently standing at ~$101 Bn.

MVRV

MVRV (Mahmudov & Puell, 2018) historically provides two important thresholds - MVRV above 3.7 could signal potential overvaluation and MVRV below 1 could signal undervaluation. The ratio ratio is currently at ~1.29.

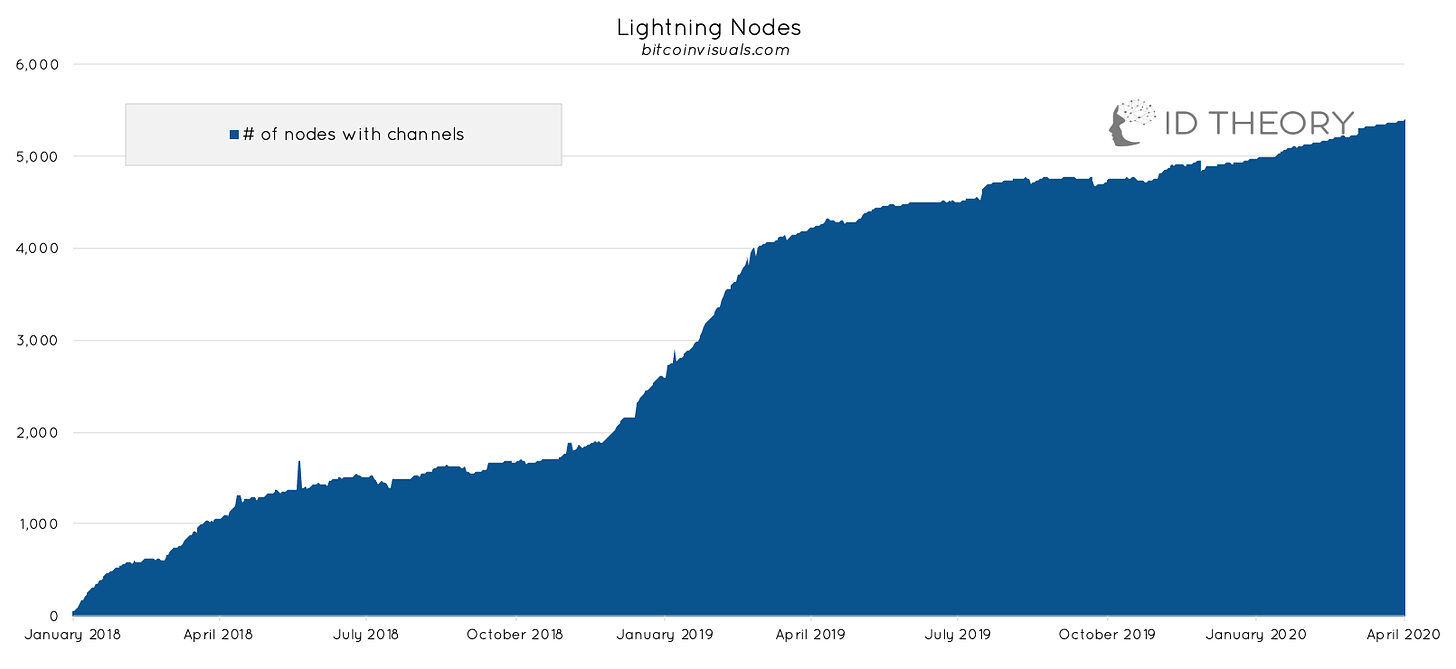

Lightning Nodes

The number of unique lightning nodes on the Bitcoin network is up 1%. The number of nodes is up 10% YTD.

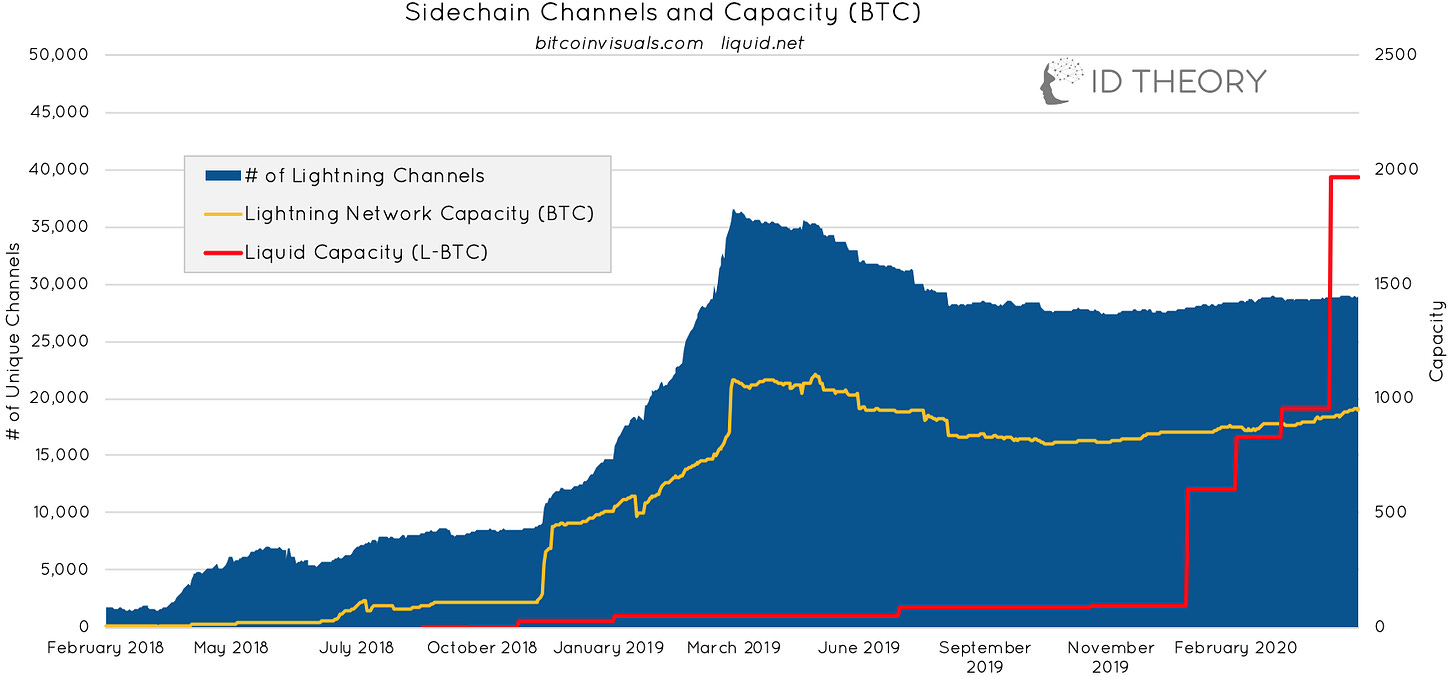

Sidechain Channels and Capacity

The number of unique channels on the lightning network is flat for the week. The BTC capacity on the Lightning Network is up 1% for the week (total capacity is ~953. BTC). Liquid, Blockstream’s Bitcoin sidechain, has now achieved a capacity of ~1940BTC which represents 2x the capacity seen on lightning.

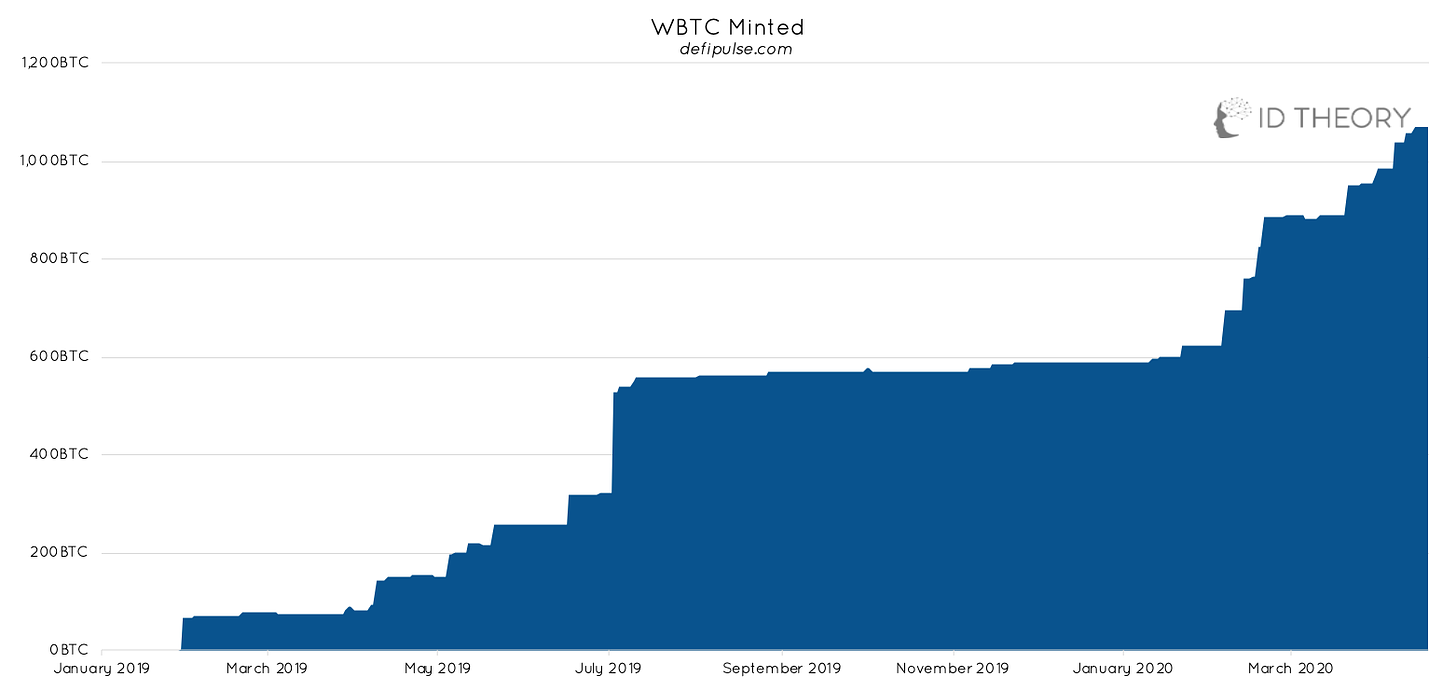

Wrapped BTC

The total value of Wrapped BTC is up 1% in the past week. There are now 1070 WBTC, which represents an increased interest in using BTC within the Ethereum ecosystem (and by extension DeFi).

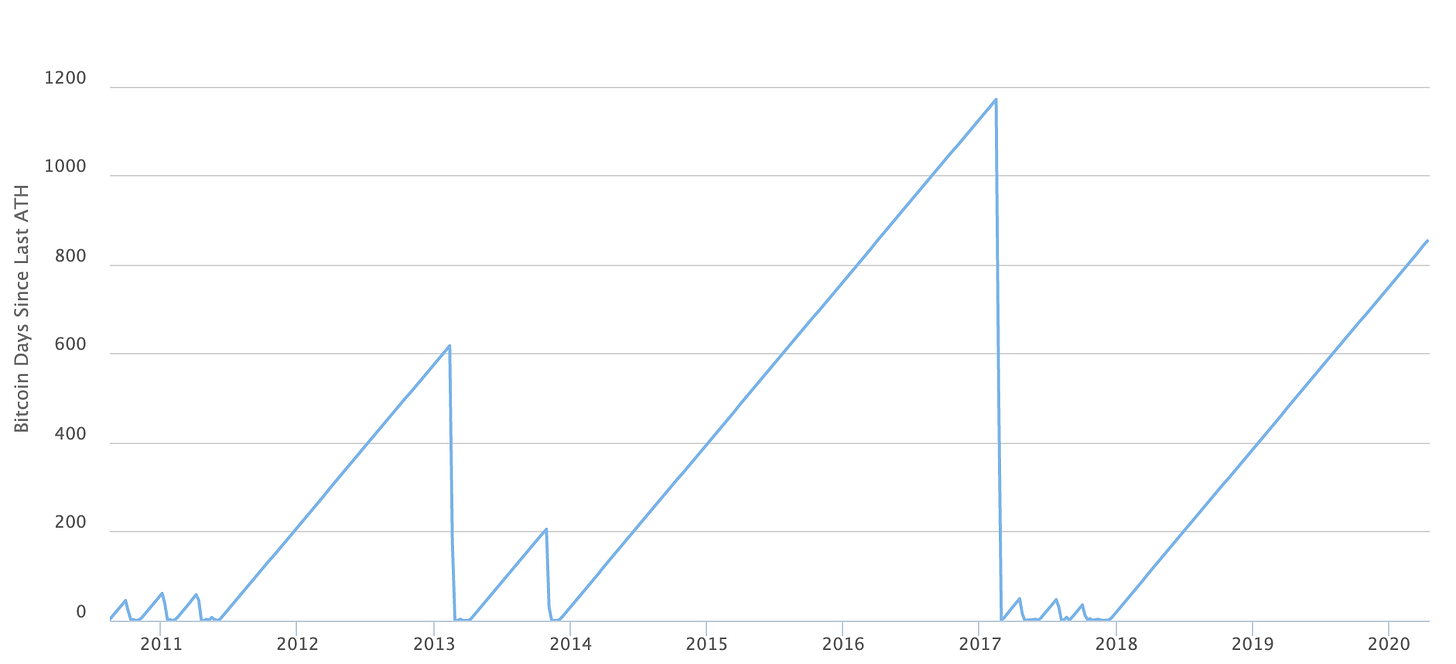

BTC Days Since All Time High

Spotlight

This week’s spotlight comes from the ID Theory team and explores 10 reasons why crypto-networks and blockchain technology are well positioned to flourish as a consequence of the emerging crisis.

Read the full article here.

Tweet of the Week

Our ‘tweet of the week’ comes from Grayscale who experienced their strongest quarter since inception. Some of key takeaways in their report include:

Grayscale raised $503.7 million in 1Q20

Grayscale Bitcoin Trust experienced a record quarterly inflow of $388.9 million

Average Weekly Investment – Grayscale Bitcoin Trust: $15.7 million

About the Author

Lewis Harland is an analyst at ID Theory and is a full-time researcher of decentralised networks and cryptoassets.

ID Theory Ltd. is an Investment Advisor for cryptoasset investment fund, IDT Crypto Asset Fund Ltd.

Interested in partnering with ID Theory or building something special? Get in touch through our website or at info@idtheory.io.