ID Theory is a London-based cryptoasset investment firm. Our weekly Insights report provides the latest key macro as well as on-chain data for Bitcoin. If you would like to receive insights directly to your inbox, you can subscribe here.

Correlations

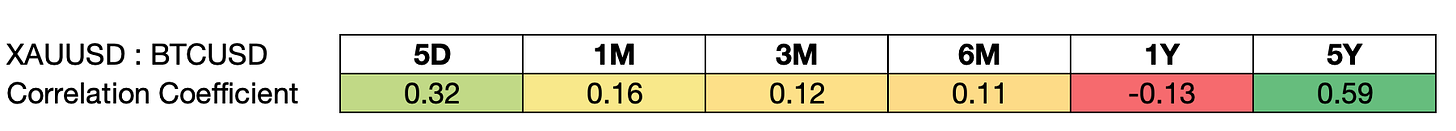

BTC and Gold

Gold has served as a safe haven asset for 1000’s of years.

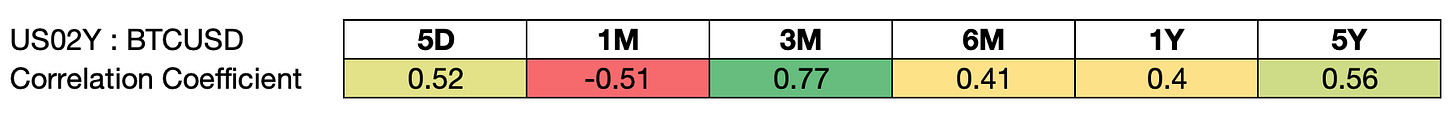

BTC and Inverted US 2 Year Treasury Yield

In a risk-off environment Treasury yields drop (and hence inverted yields rise).

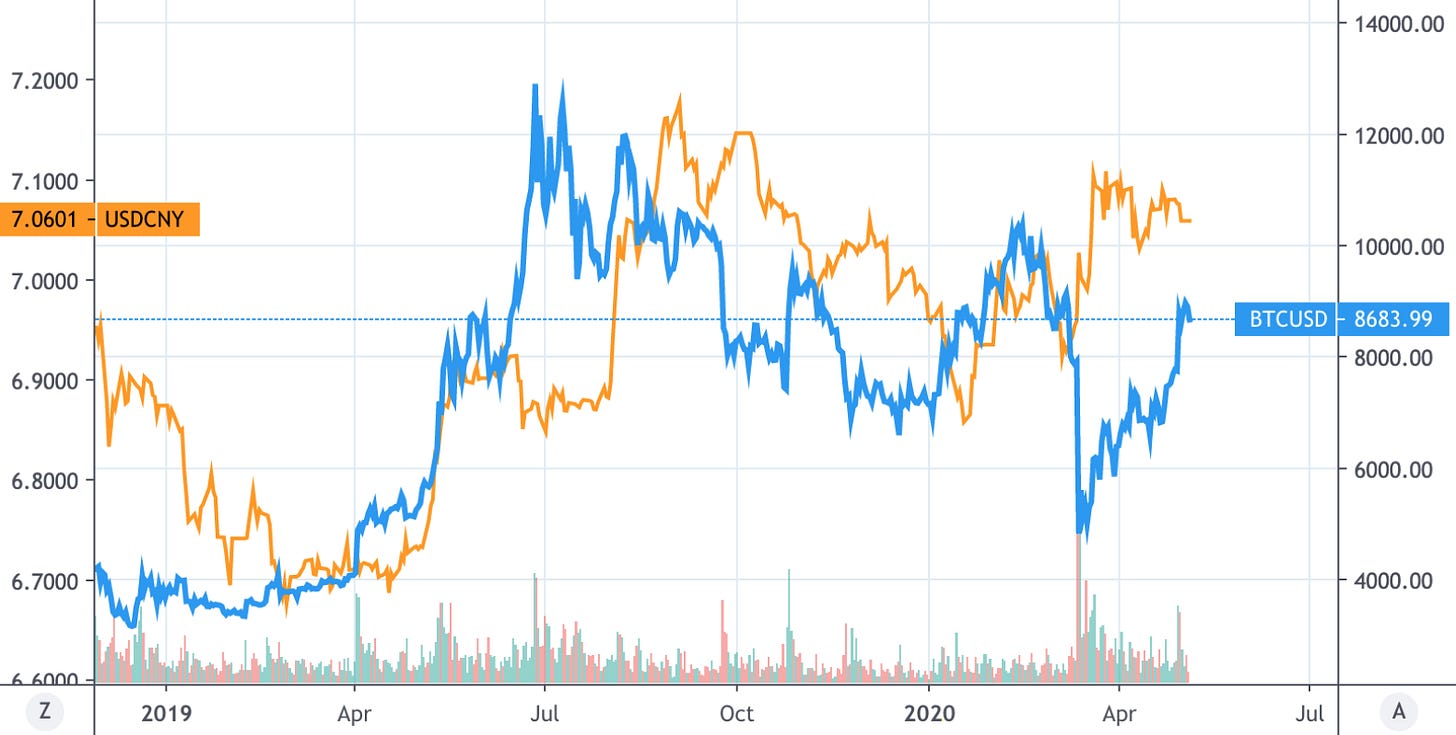

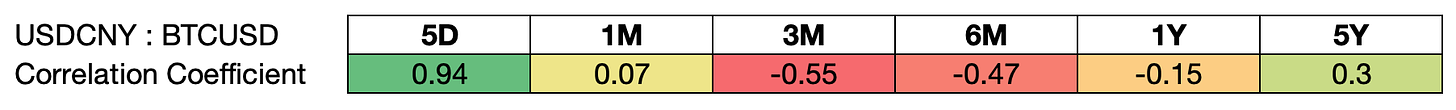

BTC and USD/CNY

Weakening CNY may lead to a greater demand for capital flight from China.

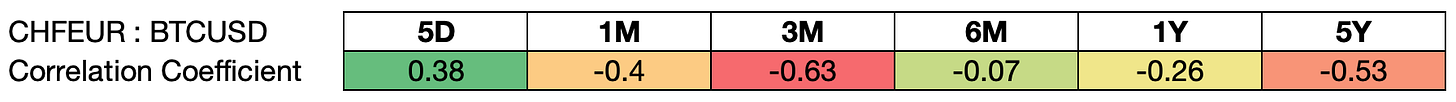

BTC and CHF/EUR

The Swiss Franc (CHF) is a safe haven currency.

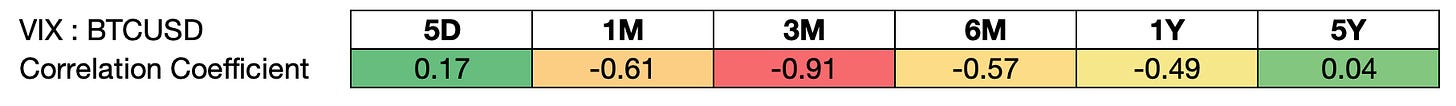

BTC and VIX

Volatility (represented by the VIX) generally increases in times of economic uncertainty.

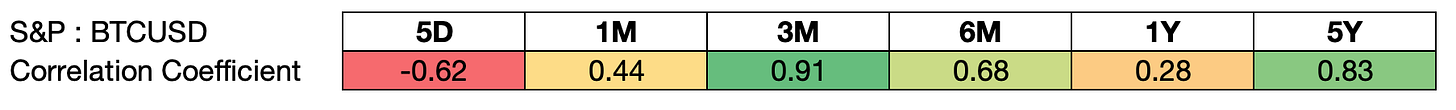

BTC and S&P 500

The S&P 500 generally rises as risk appetite increases.

BTC Daily SMAs

BTC crossed above the 100d and 200d MA on 29th April.

BTC Weekly SMAs and MACD

The weekly MACD continued to rise above the signal line providing stronger indication of bullish momentum.

Bitcoin Derivative Market

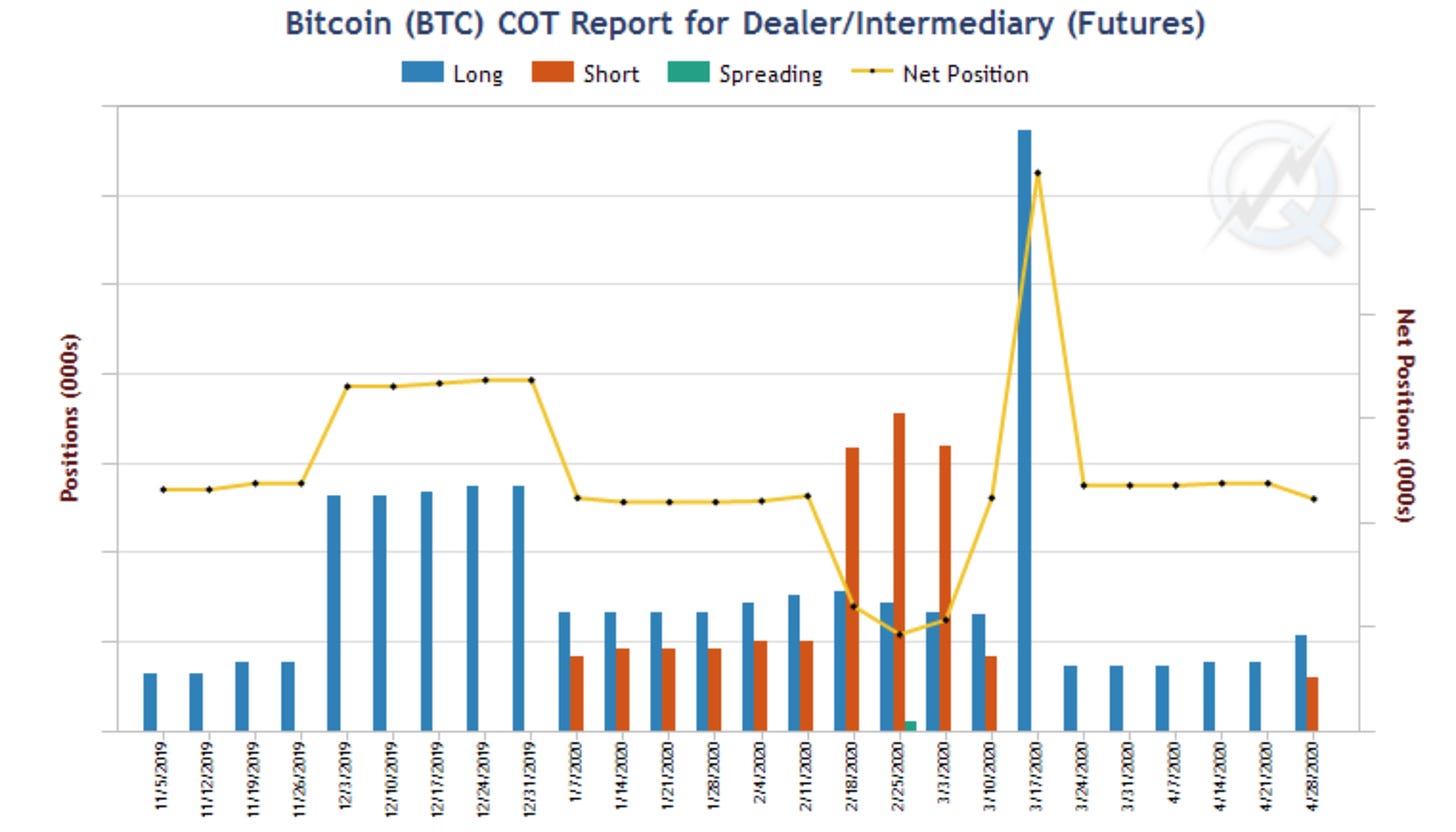

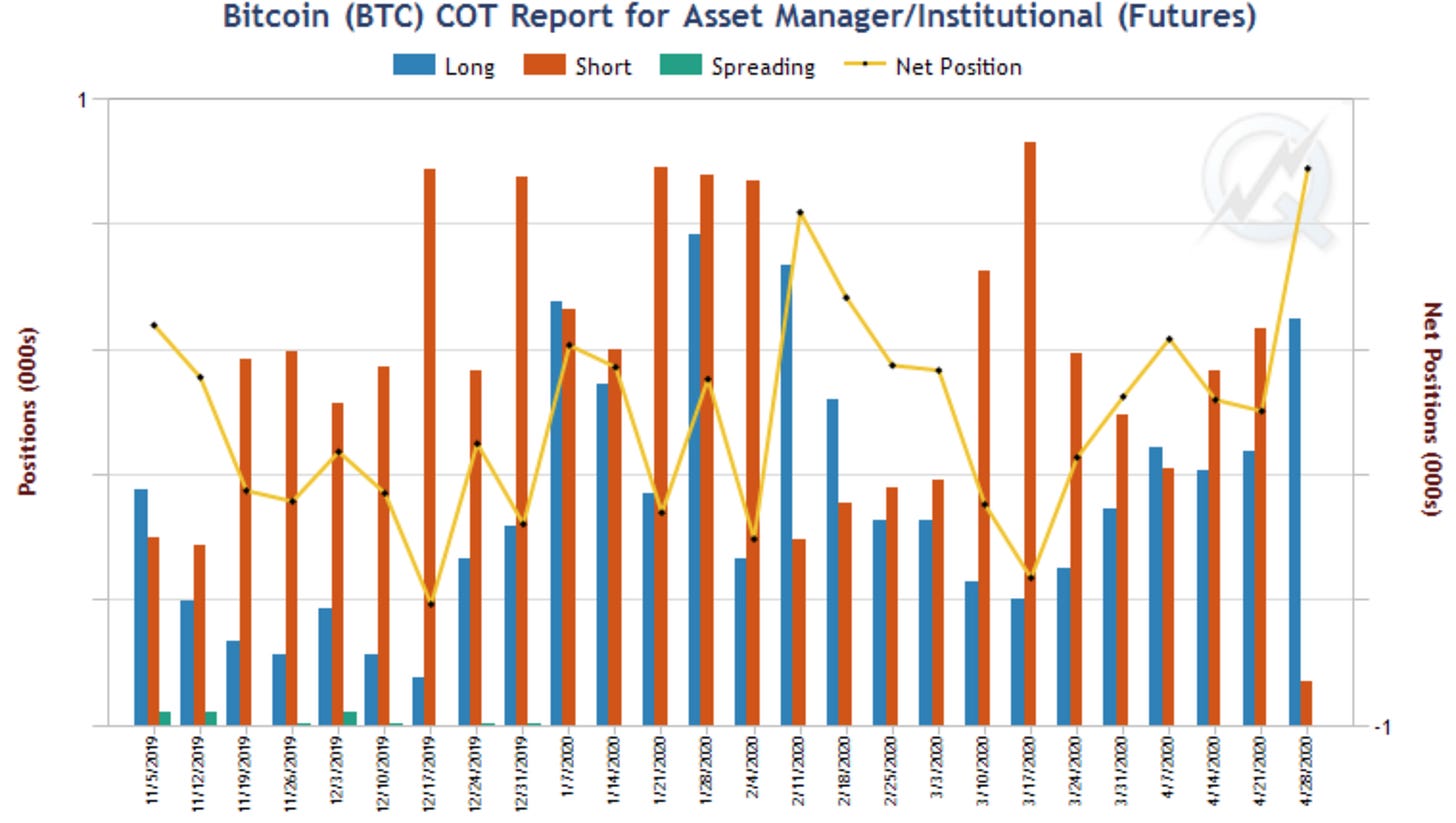

The Commitment of Traders (COT) is a weekly report issued by the CFTC enumerating the holdings of participants in the Futures market. Dealer/Intermediary represents the sell side, Asset Manager/Institutional represents the buy-side.

Dealer/intermediaries continues to hold a predominantly long stance. However, there has been a sentiment shift in asset managers as they move to a predominantly long stance from the previous week.

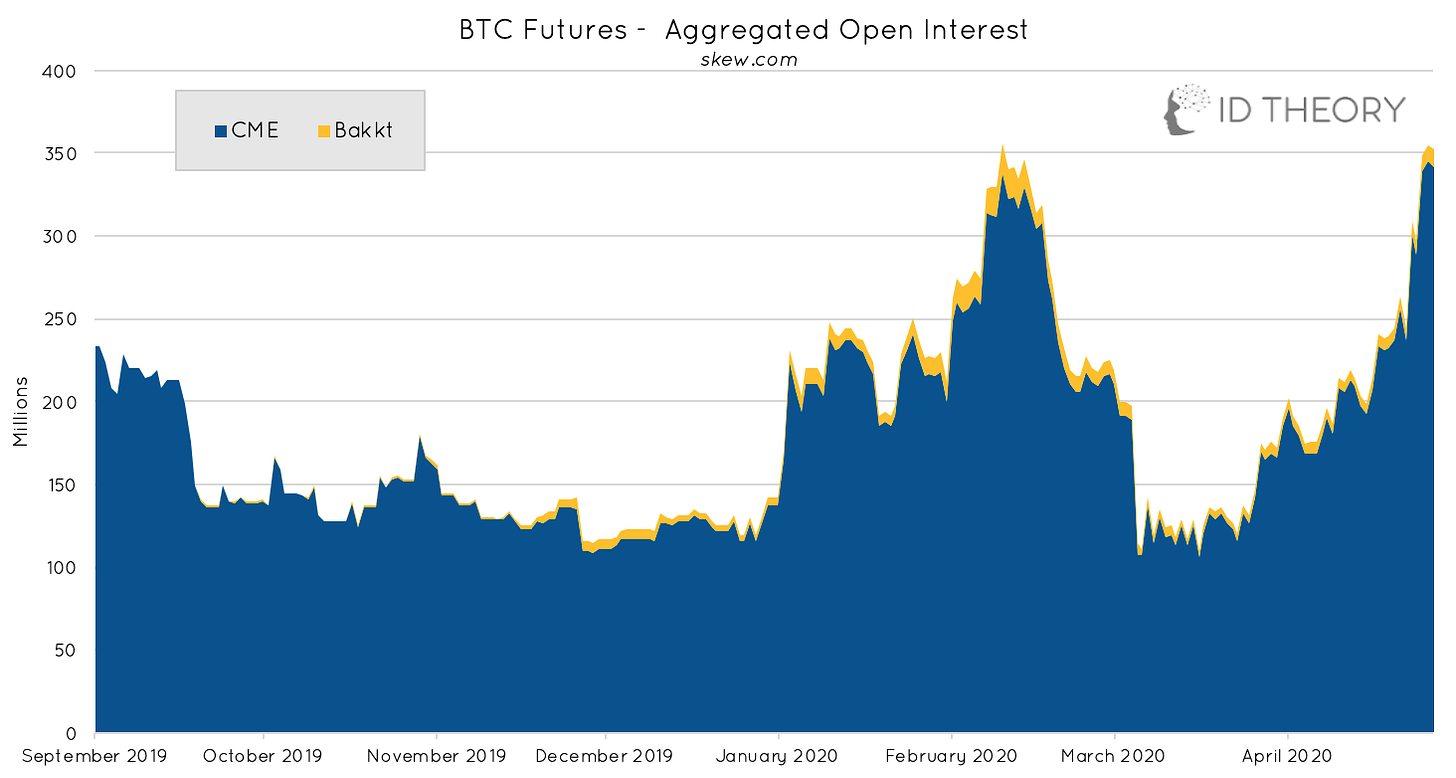

Open interest shows the USD value of open contracts offered by various platforms.

BTC Futures open interest has climbed higher than the open interest seen in February this year

Fundamentals

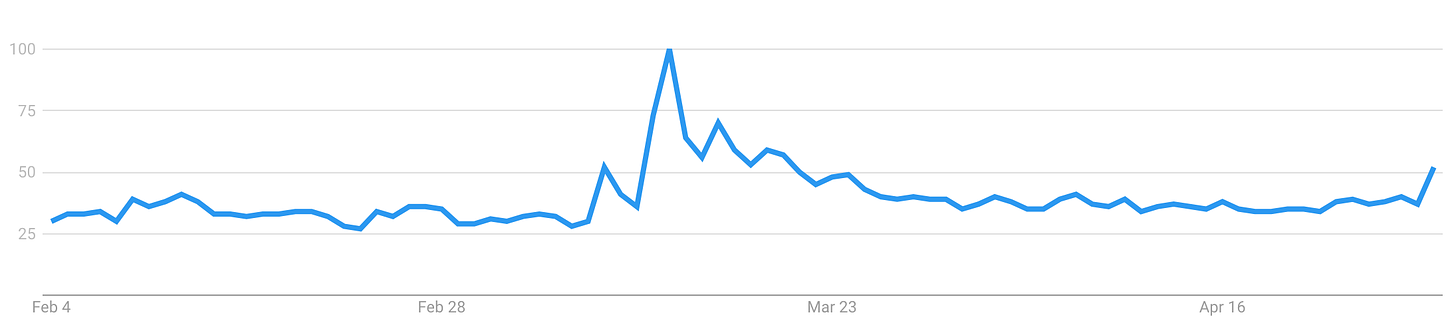

Google Trends - ‘Bitcoin’

Past 3 months - Worldwide

There has been a slight surge in searches for ‘Bitcoin’ in recent days, breaking the overall flatness seen over most of April.

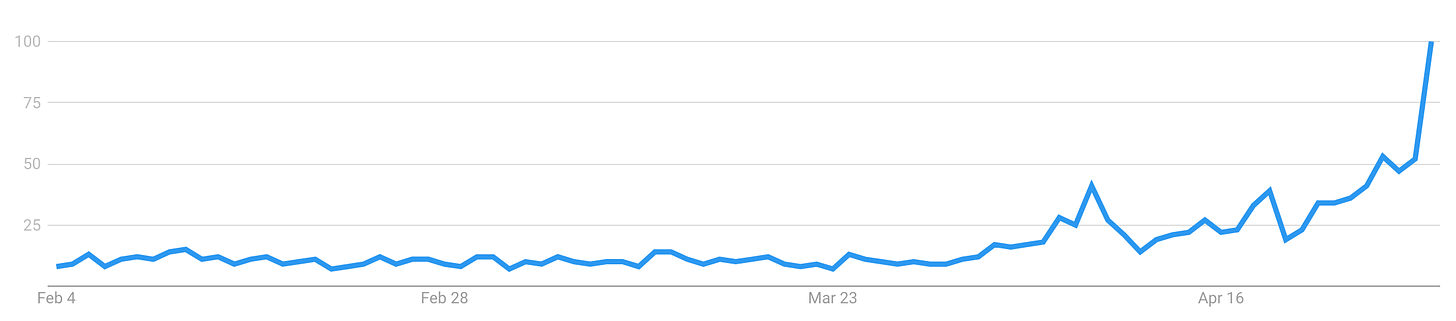

Google Trends - ‘Bitcoin halving’

Past 3 months - Worldwide

Searches for ‘Bitcoin halving’ is at the highest levels seen over the past 3 months as the ‘halving’ occurs in ~7 days.

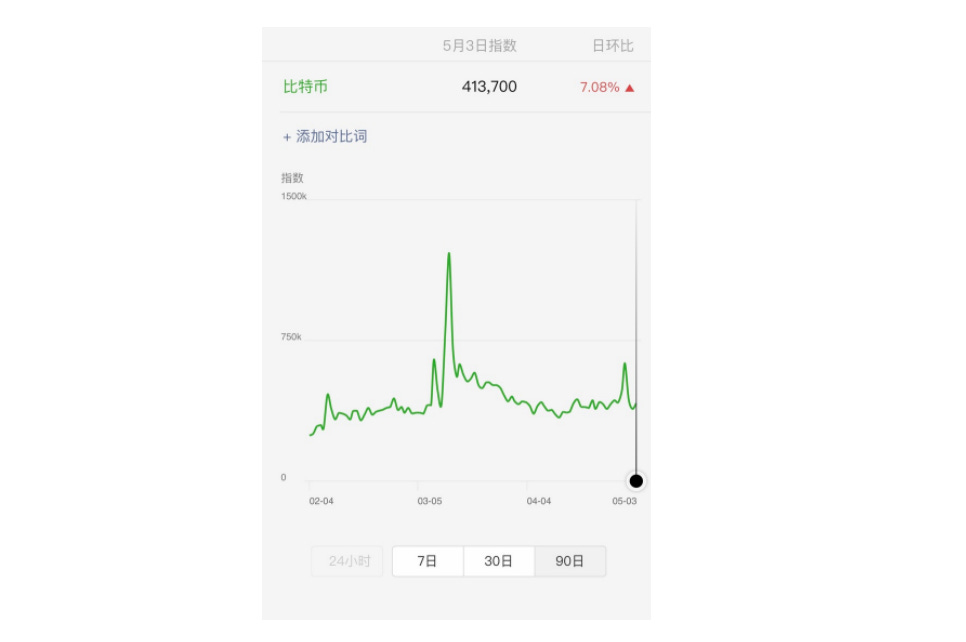

WeChat Index - ‘Bitcoin’

Searches for ‘Bitcoin’ on WeChat briefly spiked 30% on 30th April.

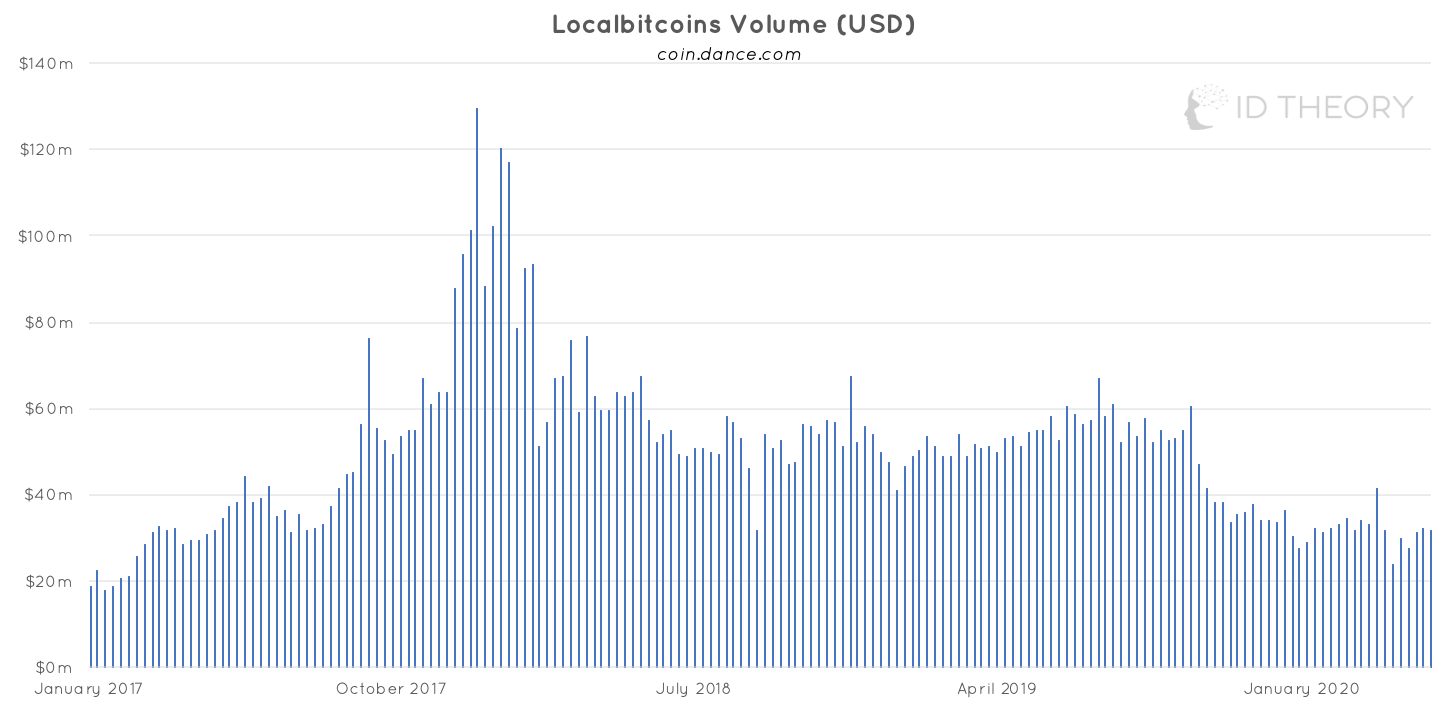

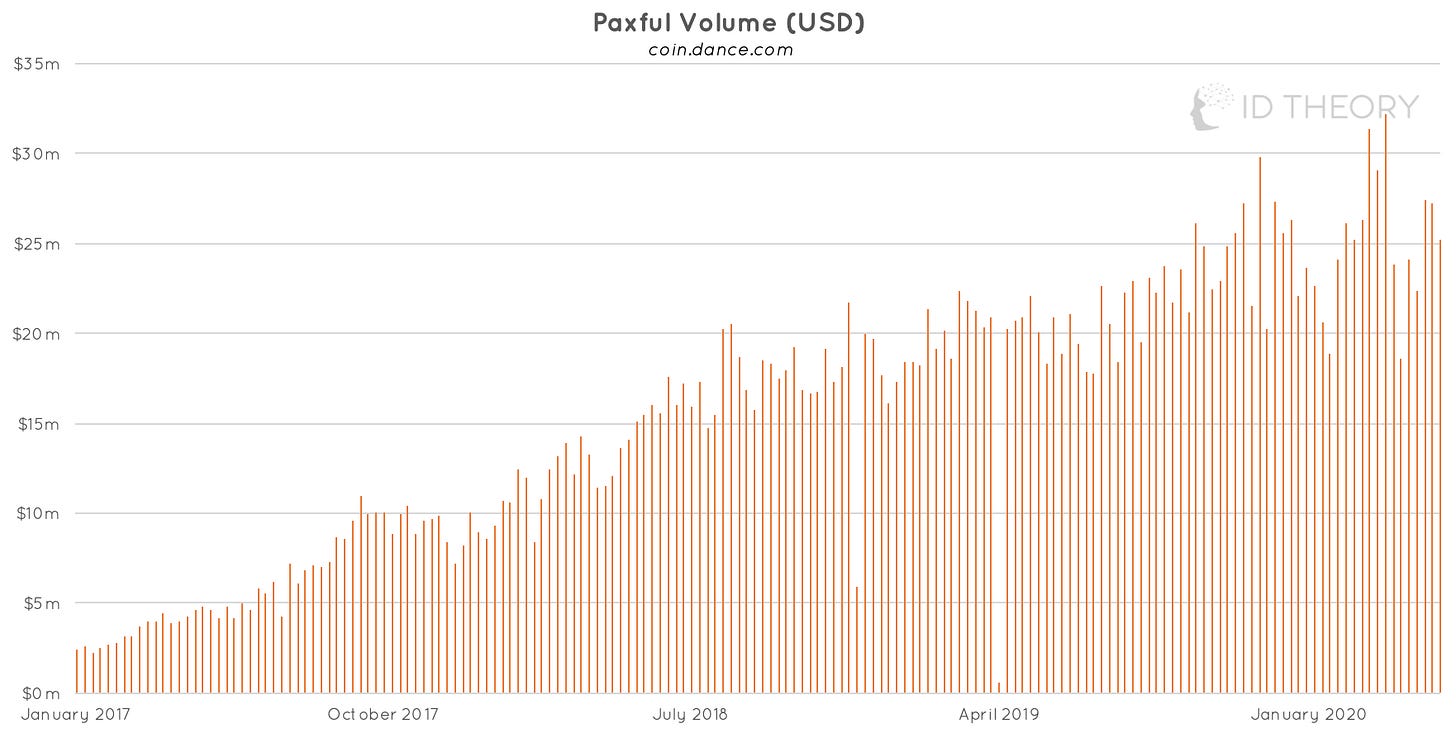

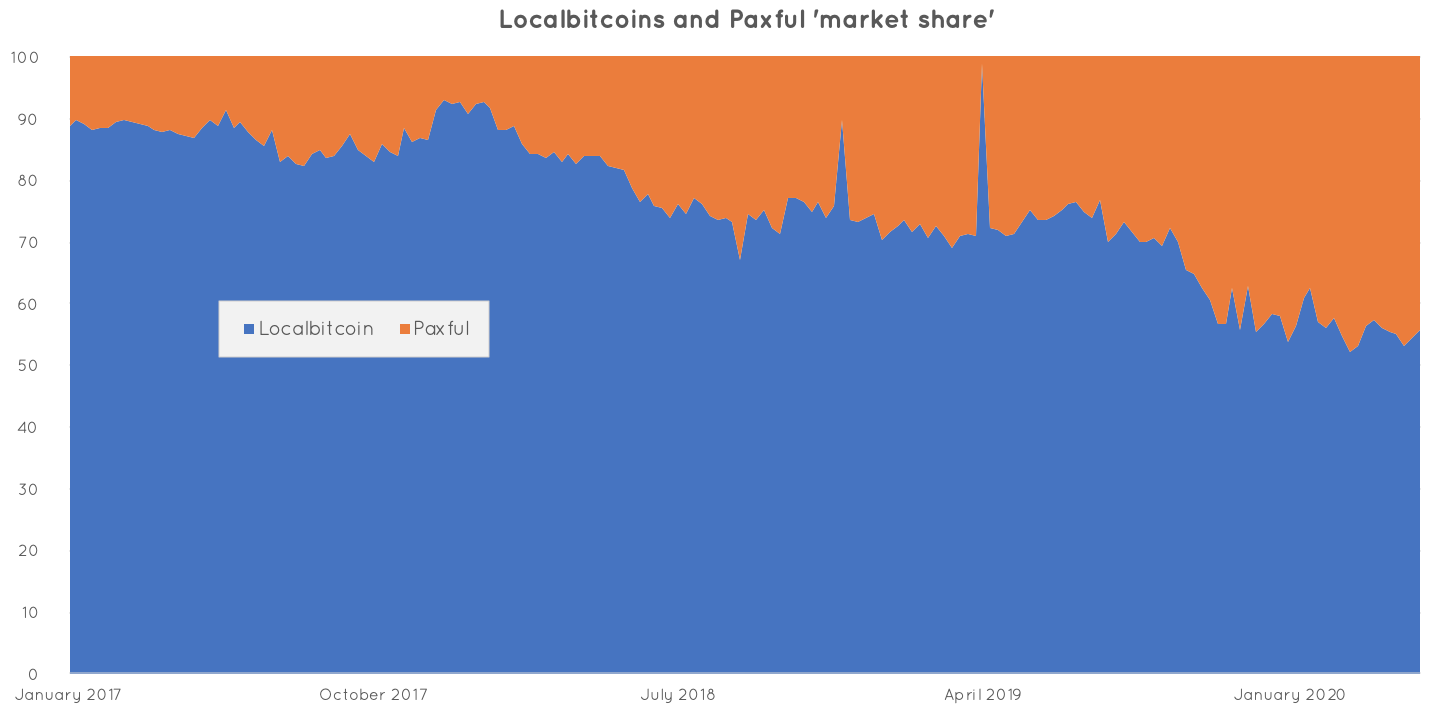

Localbitcoins and Paxful Volume - Global

USD volume on Localbitcoins is down 2% from the previous week.

USD volume on Paxful is down 7% from the previous week.

Localbitcoins volume represents ~60% of the combined USD volume of Localbitcoins and Paxful.

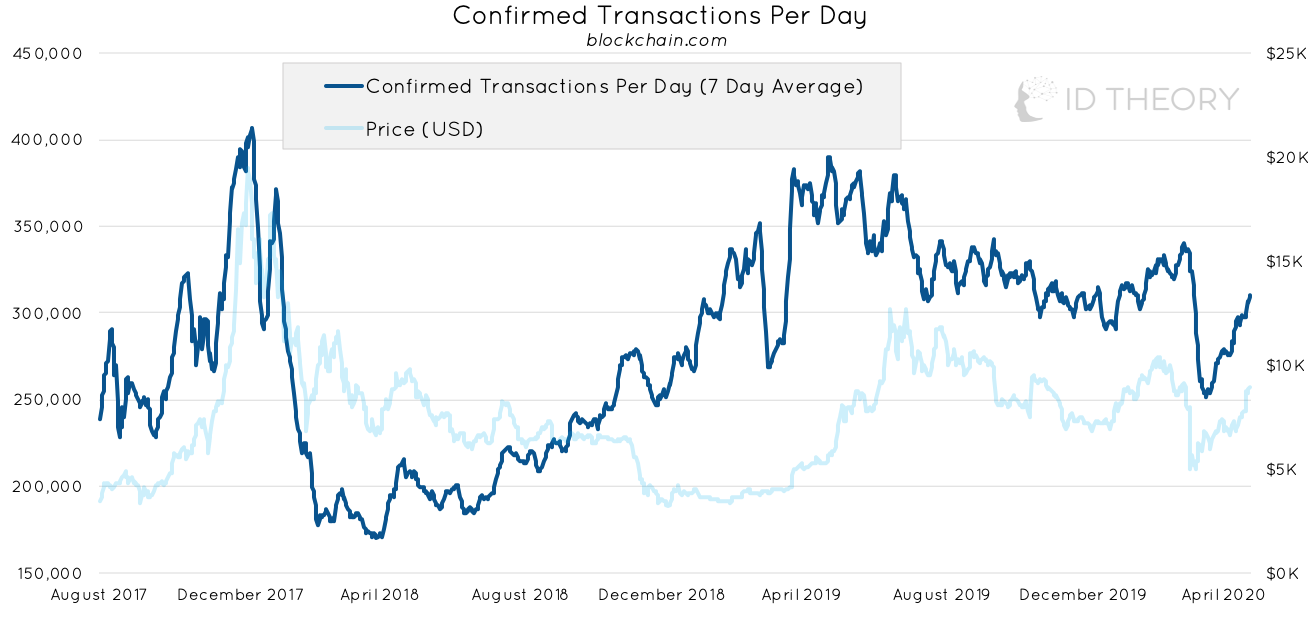

Confirmed Transactions Per Day

Confirmed transactions are up 4% since last week and up 5% YTD.

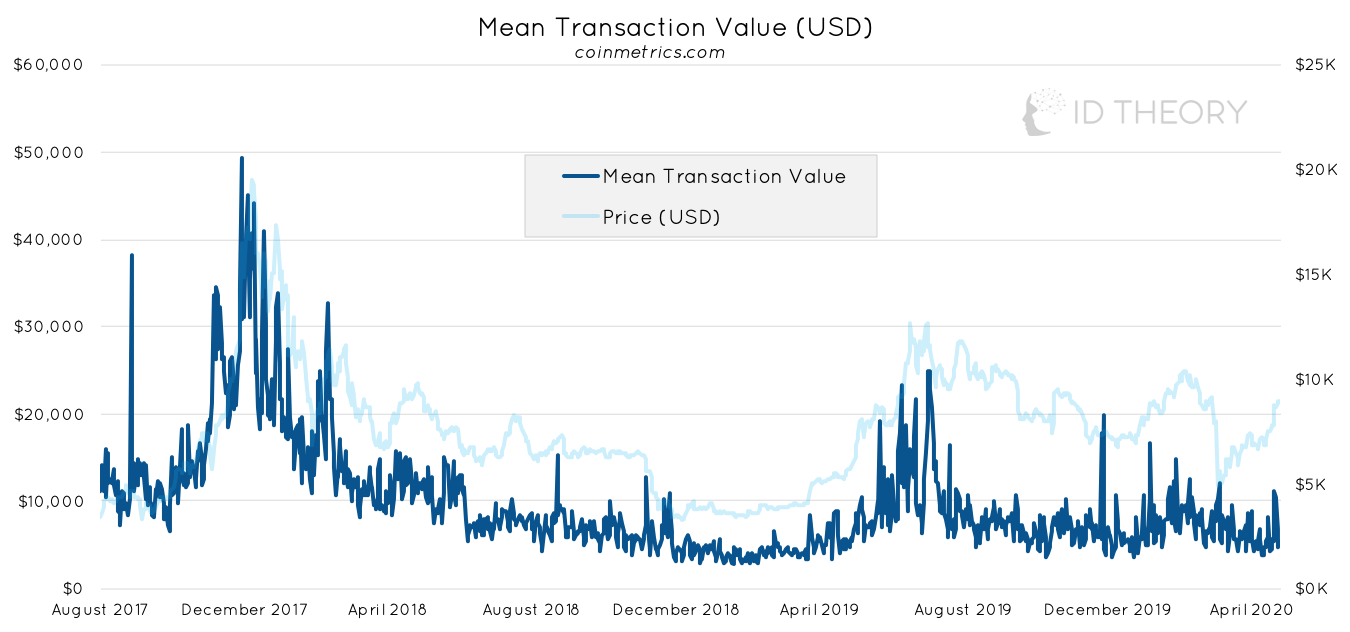

Mean Transaction Value

The mean transaction value has increased 18% for the week and is up 44% YTD.

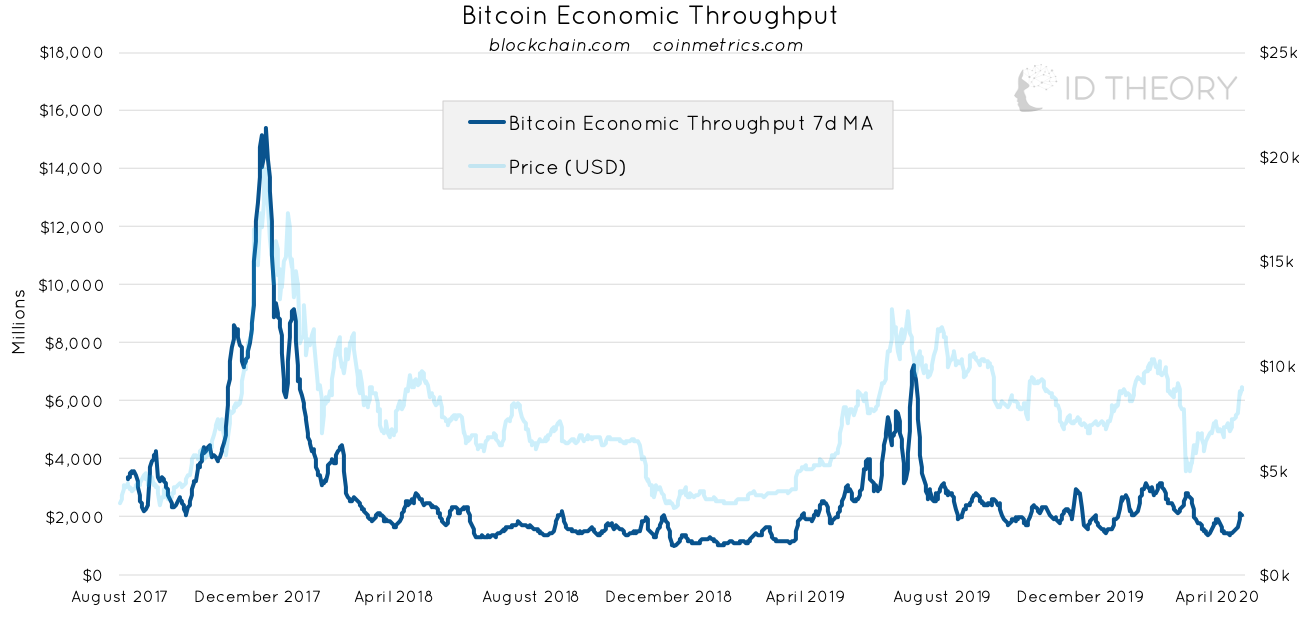

Bitcoin Economic Throughput

Current economic throughput is up 35% since last week hovering around $2.14Bn USD and is up 47% YTD on the 7d MA (moving average).

Hashrate

Bitcoin hashrate (7 day moving average) is up 1.4% for the week. Hashrate is up 17% YTD. It is currently at 113m TH/s on the 7 day moving average.

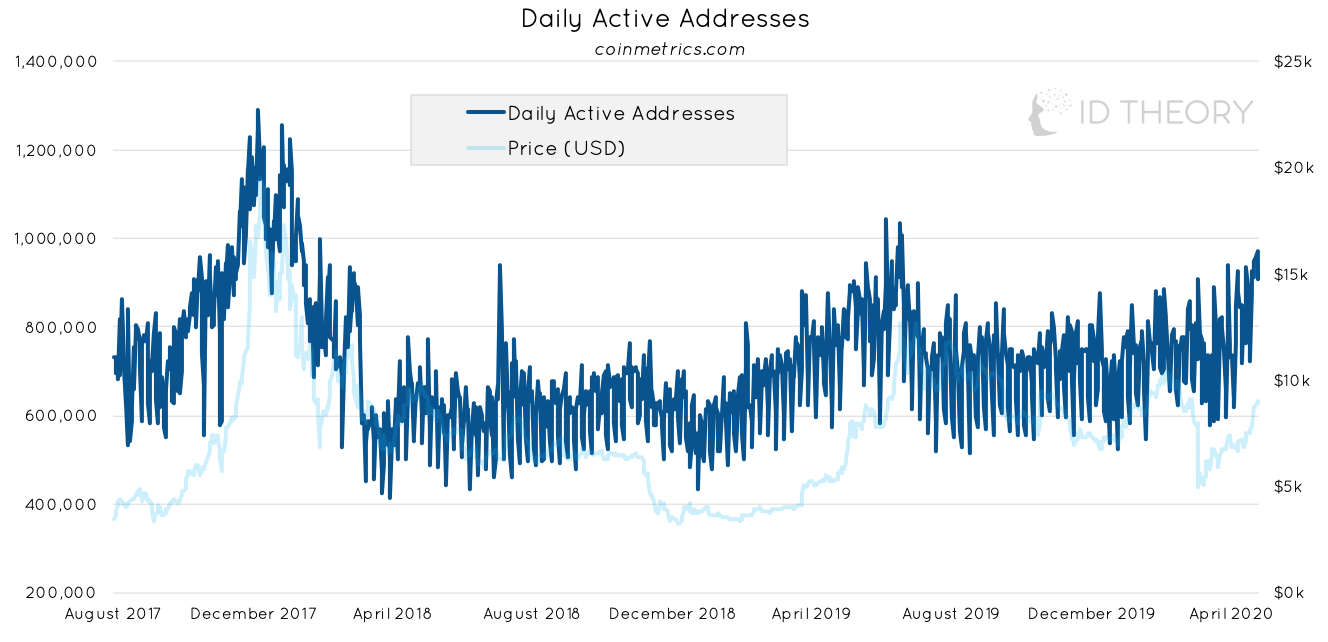

Daily Active Addresses

The daily active addresses count for Bitcoin is up 26% from the last week. Daily active address count is up 74% YTD.

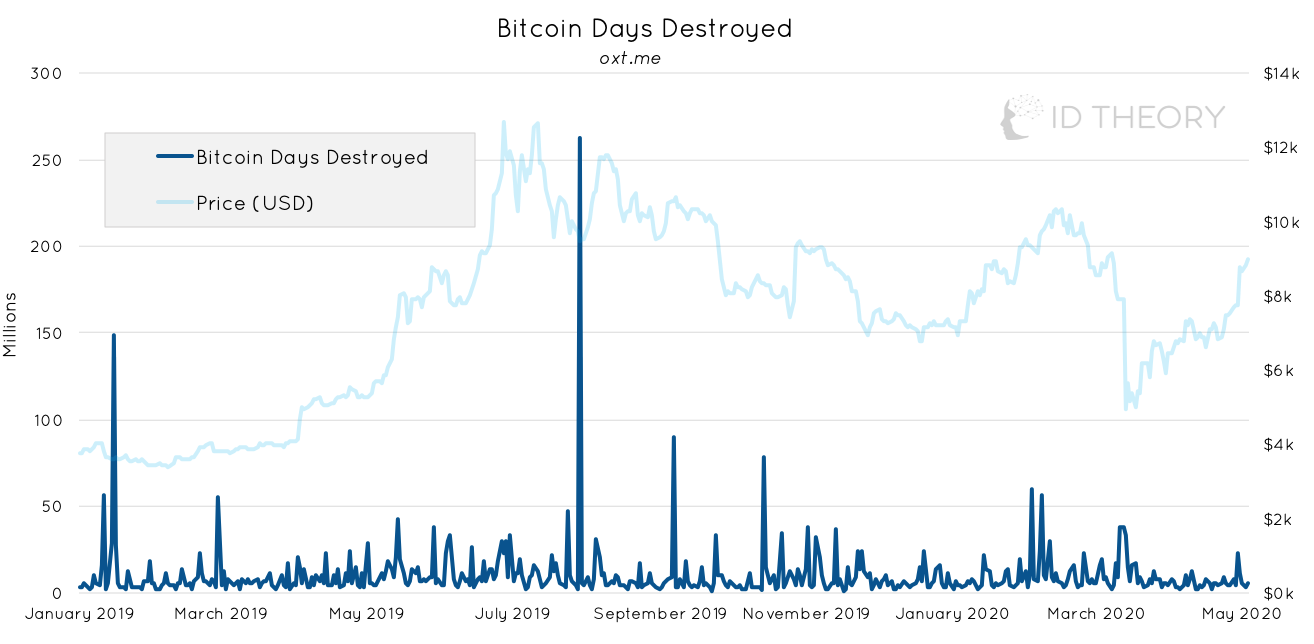

Bitcoin Days Destroyed

During the last week there has not been any significant BDD activity observed.

Realised Cap

Realised Cap (Coinmetrics, 2018) is currently standing at ~$102 Bn.

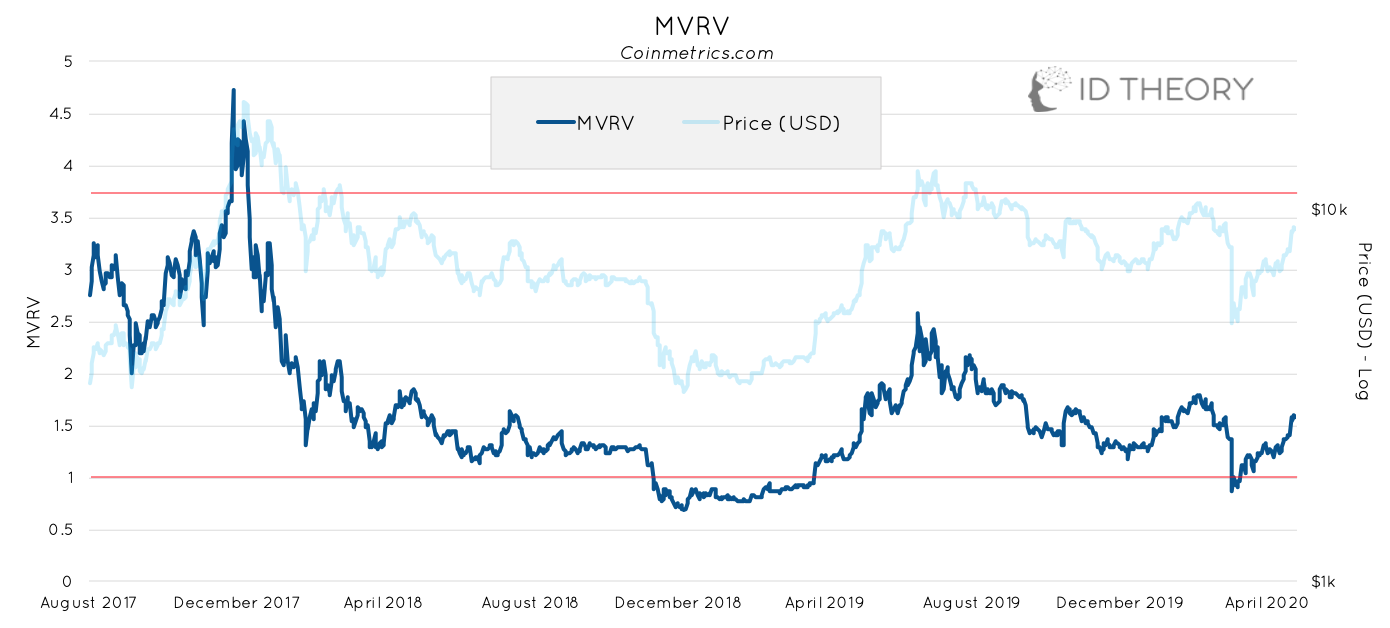

MVRV

MVRV (Mahmudov & Puell, 2018) historically provides two important thresholds - MVRV above 3.7 could signal potential overvaluation and MVRV below 1 could signal undervaluation. The ratio ratio is currently at ~1.59.

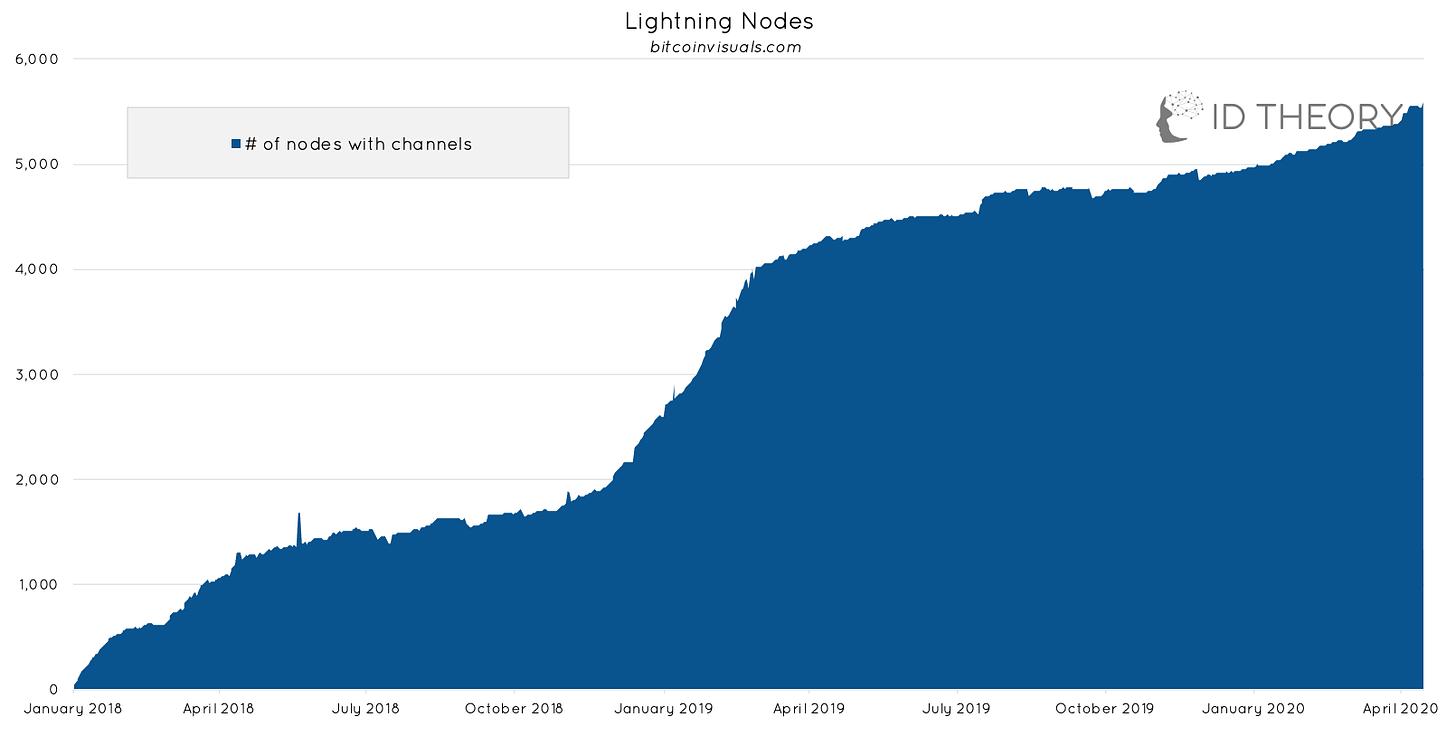

Lightning Nodes

The number of unique lightning nodes on the Bitcoin network is up 1%. The number of nodes is also up 13% YTD.

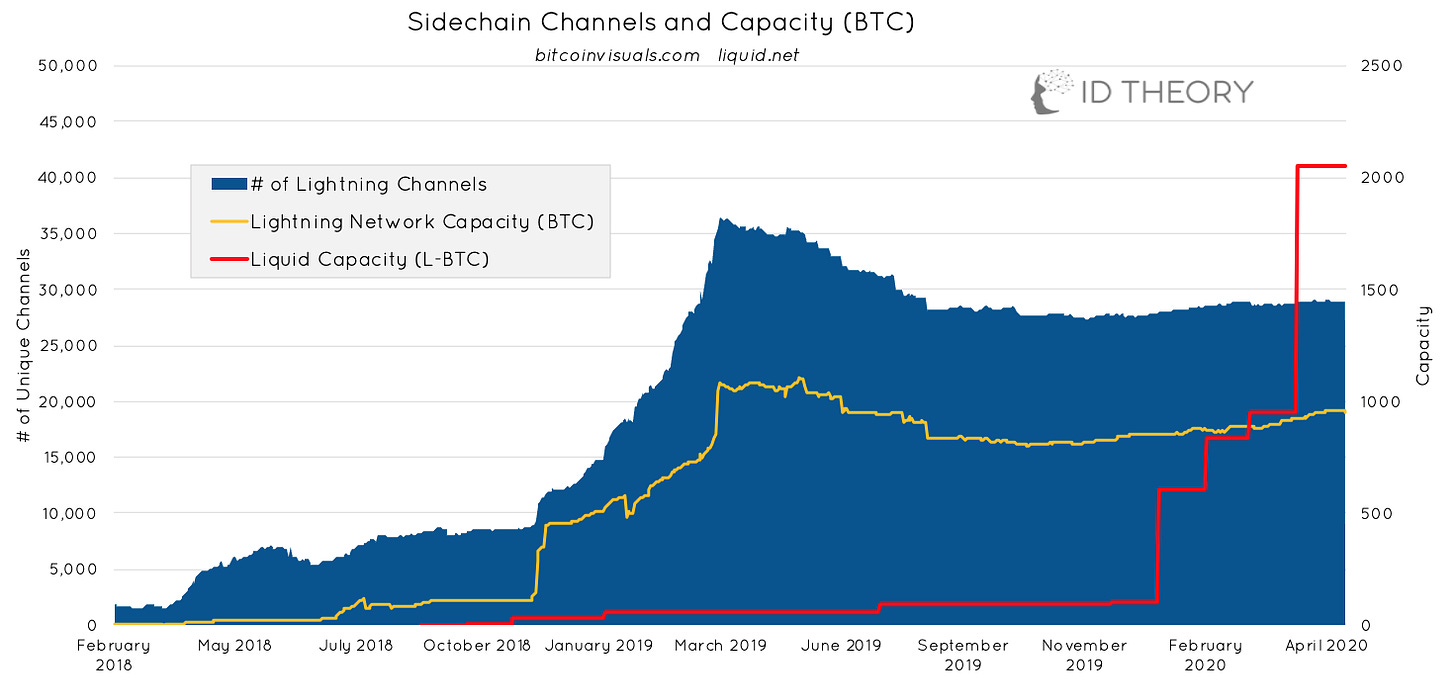

Sidechain Channels and Capacity

The number of unique channels on the lightning network is up 1% from last week (5583 total). The BTC capacity on the Lightning Network is flat for the week (total capacity is ~952. BTC). Liquid, Blockstream’s Bitcoin sidechain, has stayed flat too with a capacity of ~2054 BTC which represents 2.2x the capacity seen on lightning.

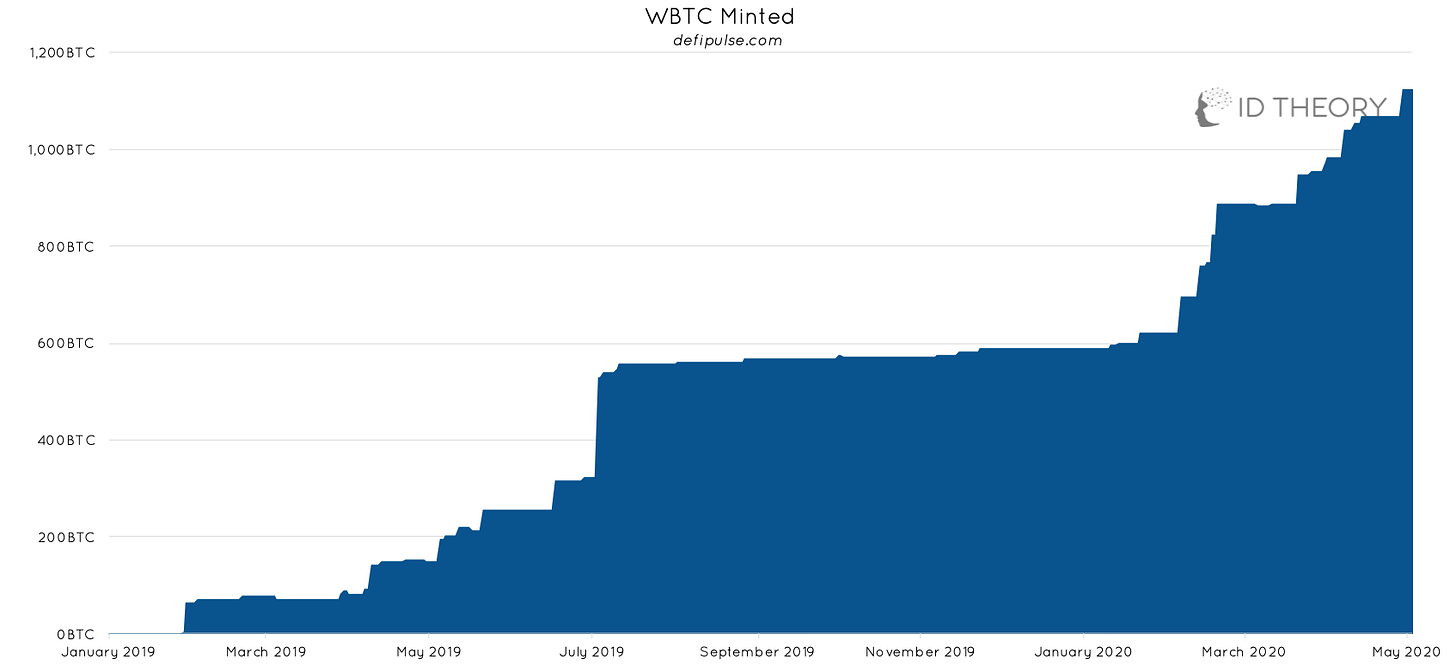

Wrapped BTC

The total value of WBTC has increase 5% in the past week. There are 1125 WBTC in circulation, which represents an increased interest in using BTC within the Ethereum ecosystem (and by extension DeFi).

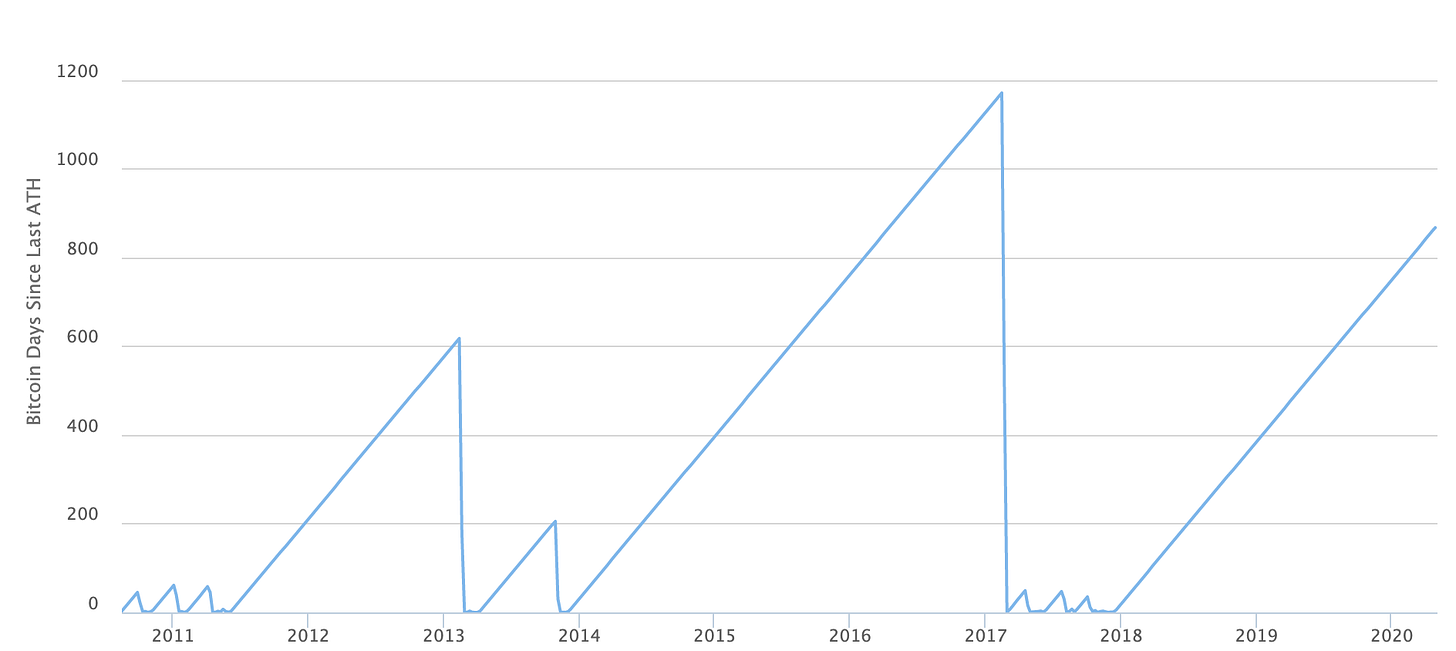

BTC Days Since All Time High

Spotlight

Our spotlight this week focuses on bitcoin addresses that have a balance of more than 10k BTC. Glassnode data shows that the 7d MA of the number of addresses rose to 111 which was the highest level seen since 2nd August and indicates increased interest from long-term holders.

Tweet of the Week

Out ‘tweet of the week’ comes from MakerDAO who announces WBTC can now be used as collateral (in the form of CDPs) to generate the stablecoin, Dai. This comes comes at a time when other synthetics of Bitcoin are also being considered for MakerDAO, such as tBTC.

About the Author

Lewis Harland is an analyst at ID Theory and is a full-time researcher of decentralised networks and cryptoassets.

ID Theory Ltd. is an Investment Advisor for cryptoasset investment fund, IDT Crypto Asset Fund Ltd.

Interested in partnering with ID Theory or building something special? Get in touch through our website or at info@idtheory.io.