ID Theory is a London-based cryptoasset investment firm. Our weekly Insights report provides the latest key macro as well as on-chain data for Bitcoin. If you would like to receive insights directly to your inbox, you can subscribe here:

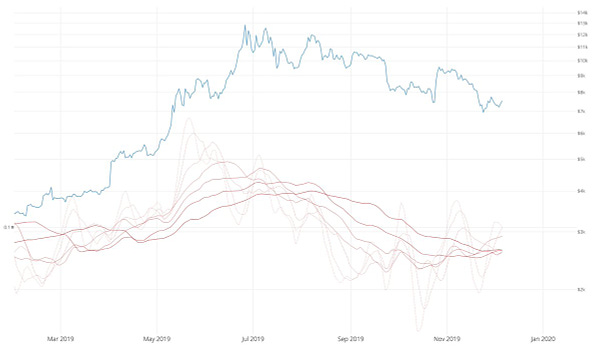

BTC and Gold

BTC and US 2 Year Treasury Yield

BTC and USD/CNY

BTC and EUR/CHF

BTC and VIX

Fundamentals

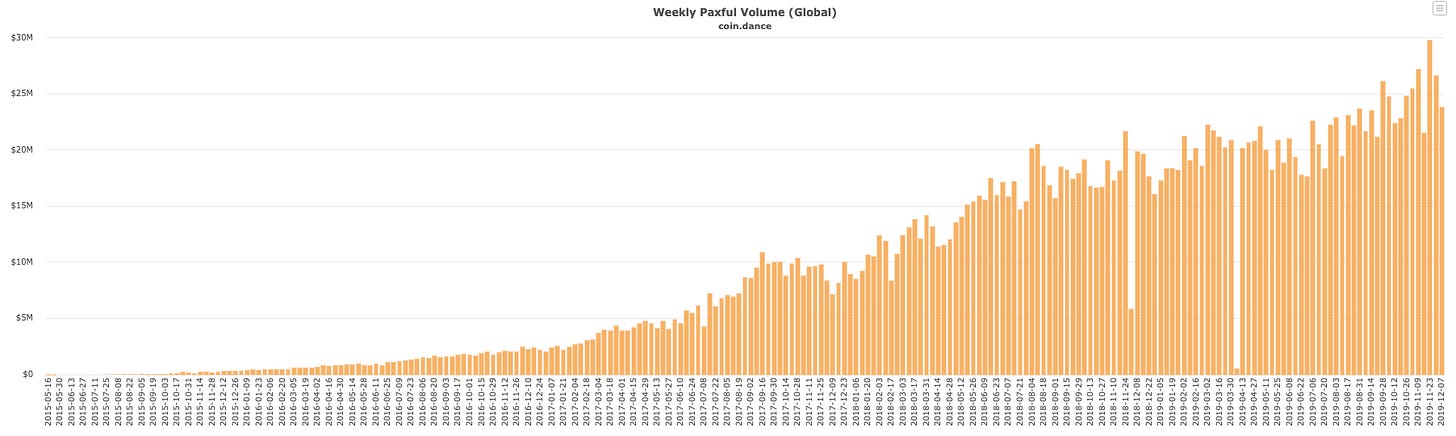

Paxful Volume - Global

BTC volume on Paxful is at $23.9m for the week commencing 7th December.

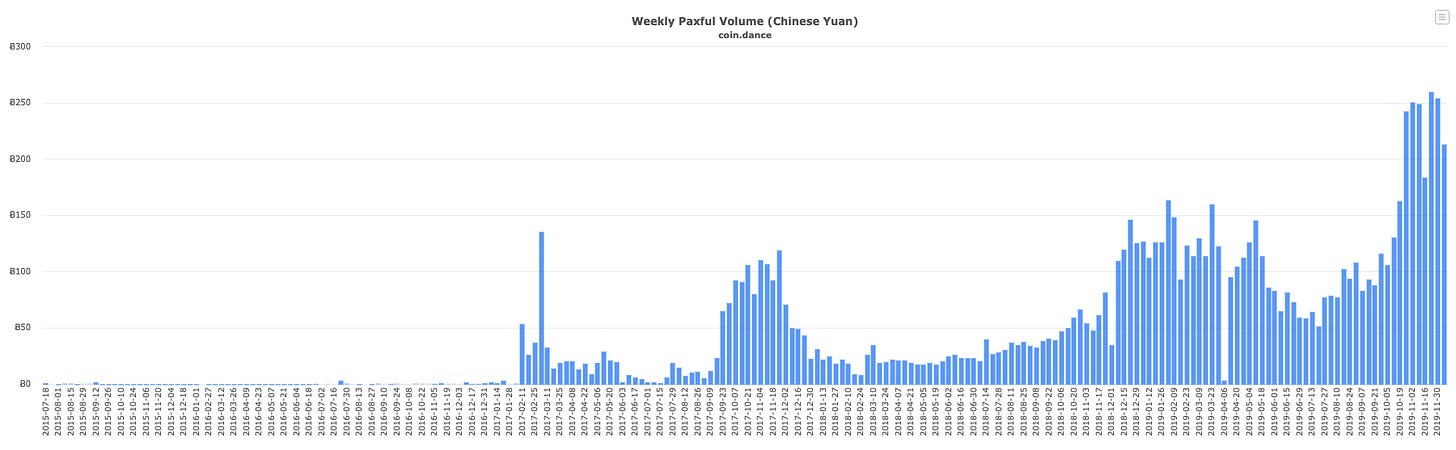

Paxful Volume - China

BTC volume in China continues to stay above the 200BTC mark. Recently, China imposed a new law that requires Chinese citizens to scan their face for any new registration for mobile phone services. China is expected to test its new digital currency by the end of the year in Shenzhen and Suzhou.

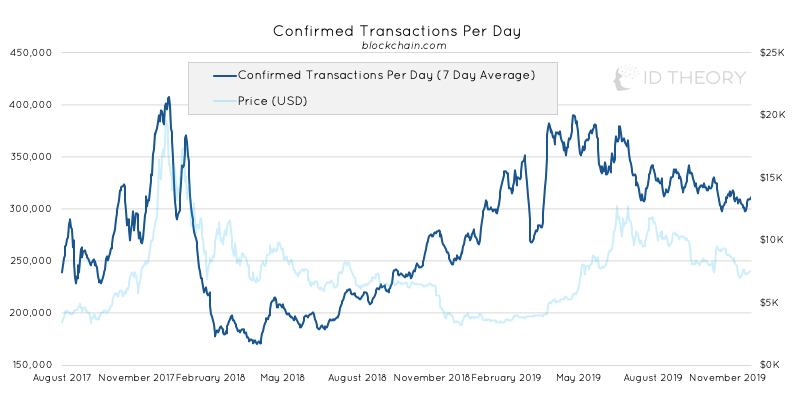

Confirmed Transactions Per Day

Confirmed transactions is up in the last week at ~310k transactions yesterday (up 4%). However, transactions per day is up 12% YTD.

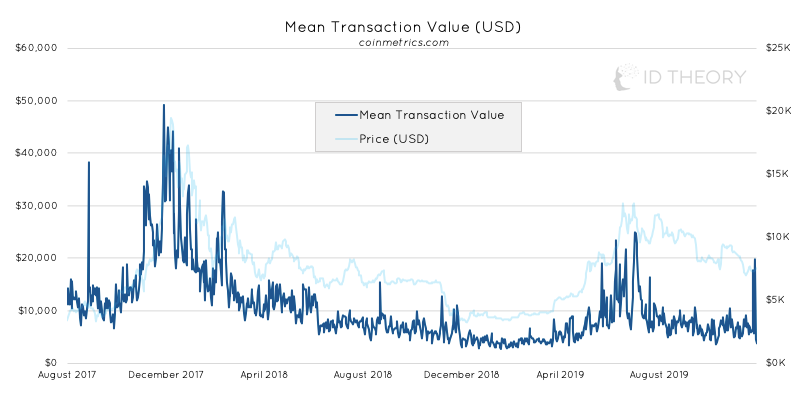

Mean Transaction Value

The mean transaction value has decreased 35% for the week and 13% YTD. There were significant spikes during the week, however, reaching $17k and $20k mean transaction value on December 4th and 6th respectively.

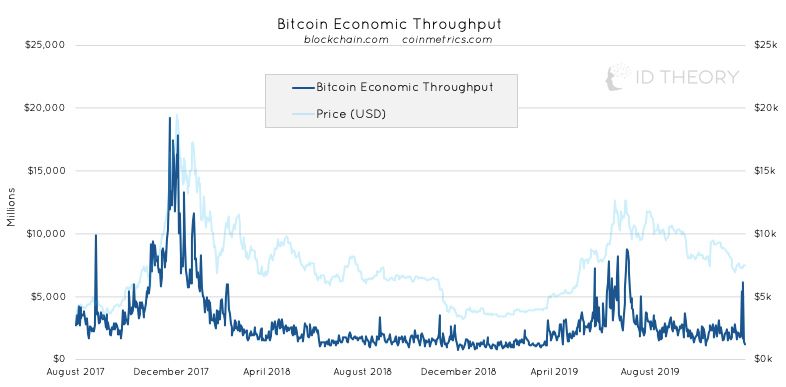

Bitcoin Economic Throughput

Bitcoin economic throughput is a measure of financial bandwidth per unit of time on the Bitcoin network. It is simply calculated by taking the average transaction size and multiplying it by the number of transactions.

Current economic throughput is down 32% hovering around $1.17Bn USD.

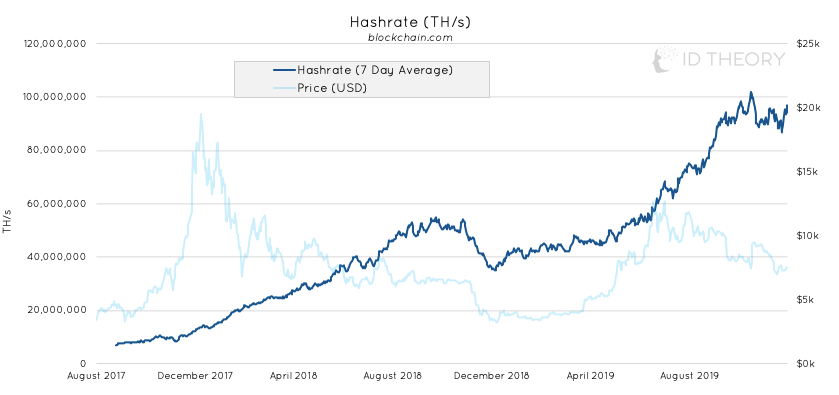

Hashrate

Bitcoin hashrate (7 day moving average) is moving back up (12% for the week). Hashrate is up 134% YTD. Currently at 96.7m TH/s on the 7 day moving average.

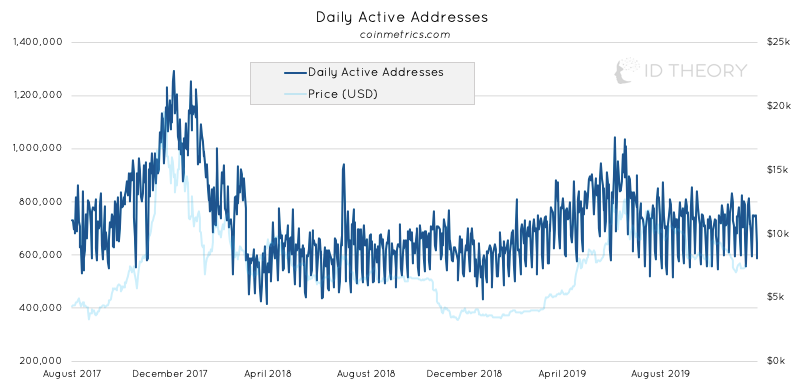

Daily Active Addresses

The daily active addresses for Bitcoin is down slightly (1%). Currently at 35% YTD.

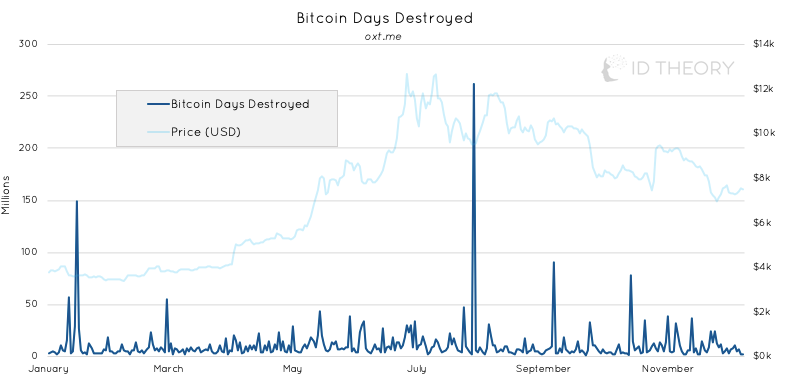

Bitcoin Days Destroyed

Bitcoin Days Destroyed (BDD) is an alternative metric for transaction volume on the Bitcoin network. It is calculated by taking the number of Bitcoins in a transaction and multiplying it by the number of days it has been since those coins were last spent.

During the last week there has not been any significant BDD activity observed.

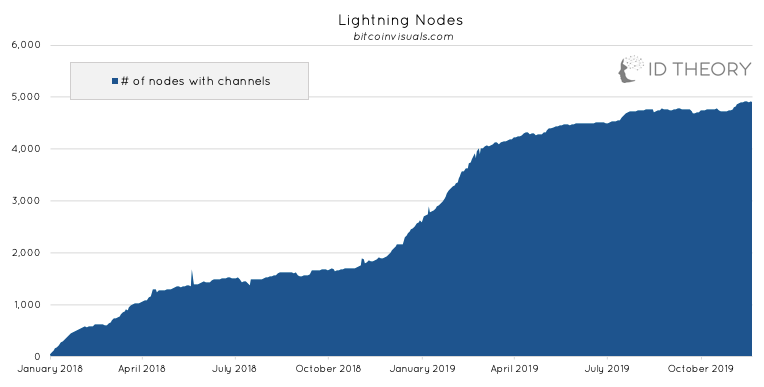

Lightning Nodes

The number of unique lightning channels on the Bitcoin network has remained flat. The number of nodes is up 114% YTD.

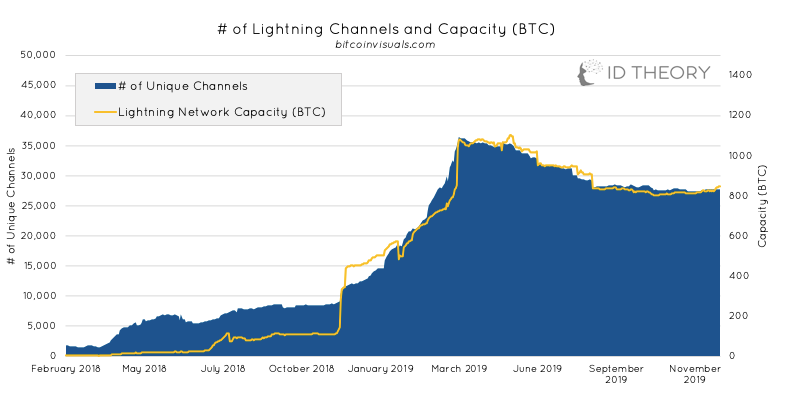

Lightning Channel

There are 27750 unique channels on the lightning network is largely flat from the previous week (0%). The BTC capacity on the Lightning Network climbed 3% (total capacity now 847 BTC).

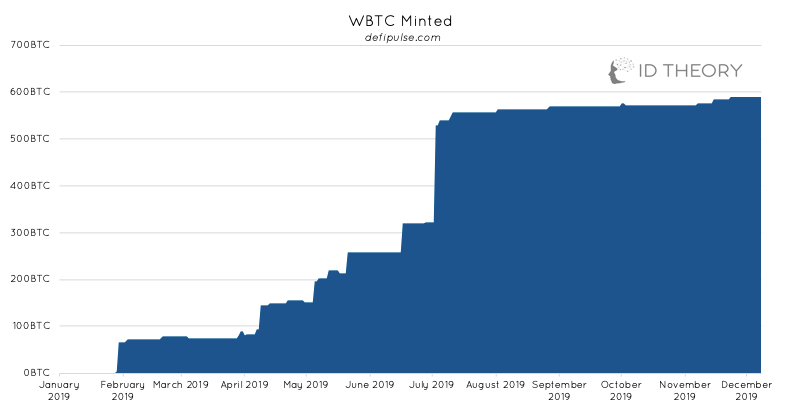

Wrapped BTC

Wrapped BTC (WBTC) is an ERC20 token backed 1:1 with Bitcoin.

The total value of Wrapped BTC has remained flat at 589 BTC.

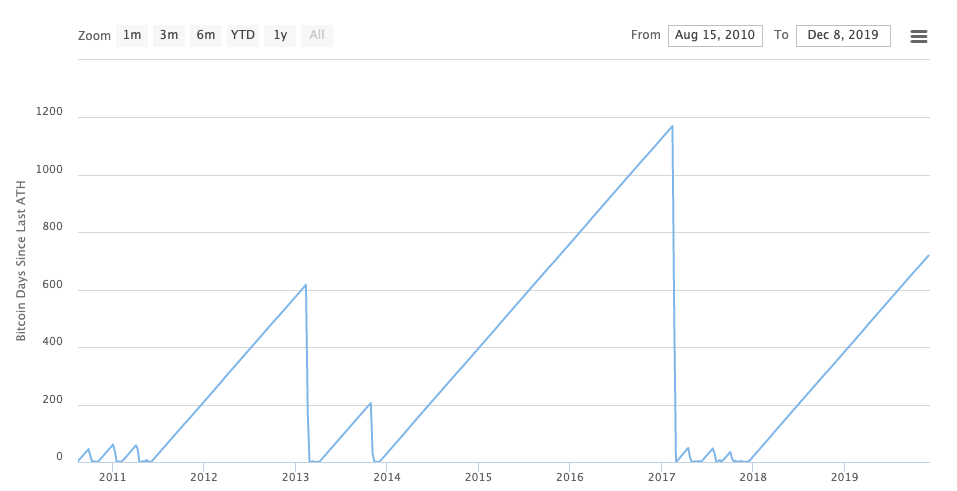

BTC Days Since All Time High

Non-zero BTC Addresses

According to glassnode, there are now 28,181,000 non-zero addresses on the network. This is still slightly under the previous ATH of 28,190,000 non-zero addresses recorded in January 2018.

Source: Glassnode

BTC addresses with Balance ≥ 1

If we take the number of addresses that have a balance above 1 BTC, there has been a continuous climb since the genesis block reaching 788k at its peak late October 2019. We are currently at 779k.

Source: Glassnode

Tweet of the Week

Our ‘Tweet of the Week’ comes from pioneering on-chain analyst Willy Woo who shows us that ‘Investor Momentum’ ,while a mysterious measure, is crossing over into bullish territory. ‘Investor Momentum’ is a propriety indicator by Adaptive Fund.

About the Author

Lewis Harland is an analyst at ID Theory and is a full time researcher of decentralised networks and cryptoassets.

ID Theory Ltd. is an Investment Advisor for cryptoasset investment fund, IDT Crypto Asset Fund Ltd.

Interested in partnering with ID Theory or building something special? Get in touch through our website or at info@idtheory.io.